Why the Rally Could Go Longer Than You Think...

One thing that's apparent to me...

There are humongous levels of bears - and bulls - who are out in force, stalking the current market rally.

My own view... I'm worried about the stock market for similar reasons as most bearish-leaning investors. A renewed downturn could happen any day now.

This recent Bloomberg article hits all the high notes of those worries...

- The Federal Reserve will continue to raise interest rates, making it harder for businesses and consumers to borrow.

- Despite lower oil prices, future data on inflation pressures may not be as weak as some anticipate.

- Consumers are starting to suffer (and leaning on their credit cards to sustain their spending).

We have to respect and prepare for those possibilities.

But it may be helpful to not get too bearish, too soon. I think there are good odds - and that's all we have to go on, probabilities - the rally can continue for another 2 to 4 weeks.

So let me explain myself...

Why should the rally continue for at least another few weeks if not longer? And why would it then have a good likelihood of "rolling over" later?

#1: Small speculators are betting against the stock market.

Every week, the folks at the CFTC (Commodity Futures Trading Commission) issue what's called the "COT" (or Commitment of Traders) Report. It assesses the number and types of futures traders who are short (betting against), long (betting for) or hedged - against the stock market.

Last week's report showed a record number of small-account traders who are shorting the small-cap Russell 2000 index - the largest number in more than a decade.

I can understand why many traders are putting on these bets. But I think they are likely too early. I mean, the stock market hasn't even had a short-term "pull back" yet on the charts.

That sort of trading activity shows a lot of over-confidence from folks thinking "the stock market has gone up 16% off the bottom - it can't go any higher."

In the COT report, the "small trader" category tends to include large numbers of inexperienced or un-savvy speculators. So almost by definition, small-account futures traders tend to be wrong (or too early) at tops and bottoms. It's just the nature of how these things work.

#2: Trendline Resistance Finally Broken to the "Upside"?

I've been posting the Nasdaq chart below for 2 or 3 weeks now, speculating that the market rally might reach the upper part of the red "downtrend" line.

So here we are, right below the trendline. The last time the market touched this trend line back in late March/early May, stocks reversed lower in a big way.

Clearly, lots of folks think that's exactly what's going to happen this time. But that's just too easy. It seems too simple. My instinct (informed by the small traders COT report mentioned above) tells me we have pretty good odds of busting through the trendline this time around.

#3: Options expiration

Lastly, you'll notice I've annotated a green dotted-line for Friday, August 19th (which is when month-dated stock options expire). Options-expirations are typically volatile, and could also serve to drive the markets higher in a way that frustrates bearish investors.

There's also an important quarterly options-expiration coming up on Friday, September 16th, if the markets continue to move higher from here.

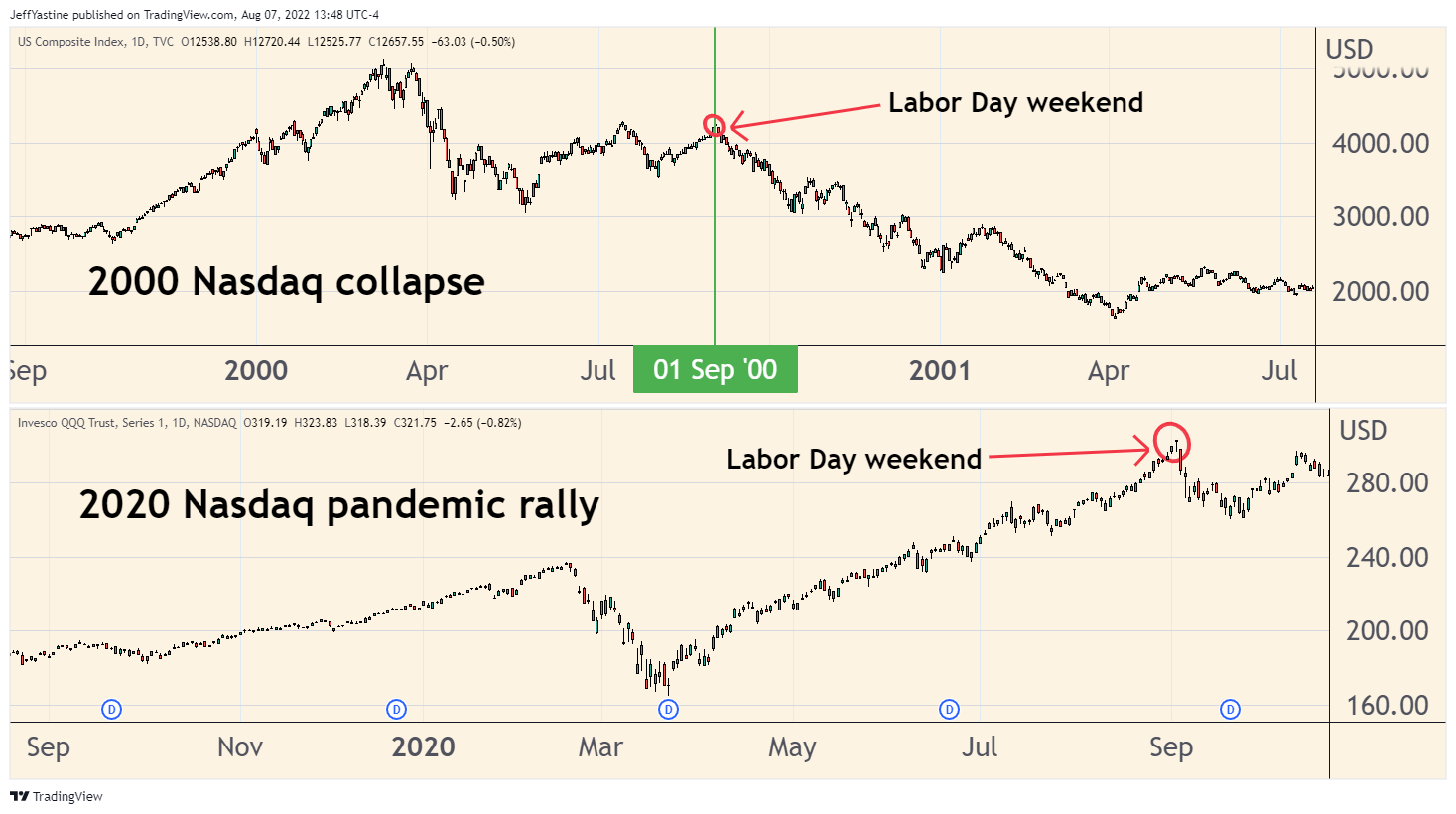

#4: Labor Day anomalies

Then there's the weirdness of Labor Day weekend...

In my opinion, it happens just often enough that we need to respect the holiday's position on the calendar before getting truly bearish on the stock market.

For example, there's Labor Day in the year 2000, and in 2020...

In 2018, Labor Day marked the first of a month-long attempt at new all-time highs before the market fell 24%:

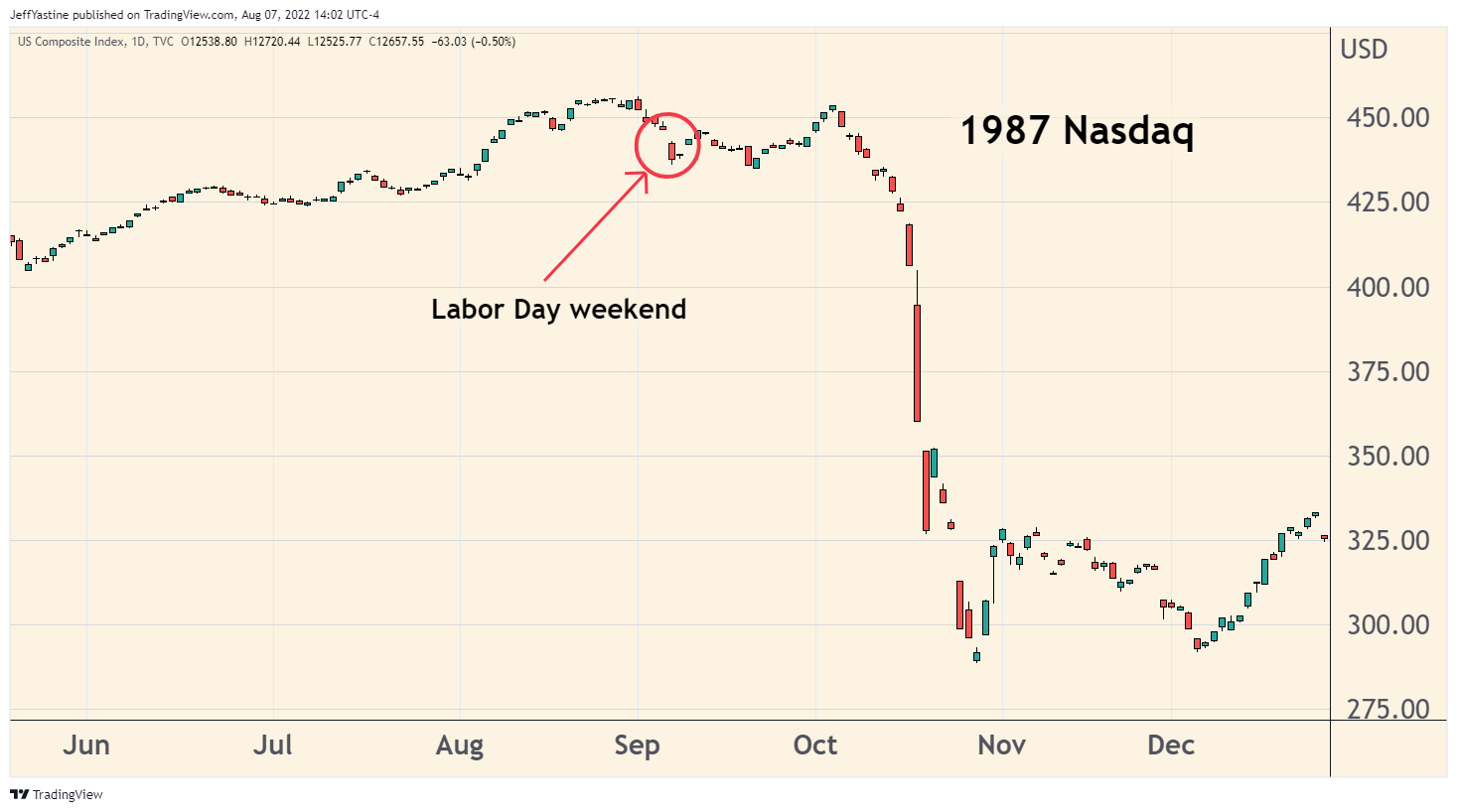

Then there's Labor Day in 1987:

I'm not predicting a crash. By definition, they happen when no one expects.

But my point is that today's bearish investors may need to suffer some sharp and unexpected pain - with more un-anticipated upward drifting in the stock market - in order to fold their cards.

Only then might the market be ready to move lower in an important way. That process could take weeks.

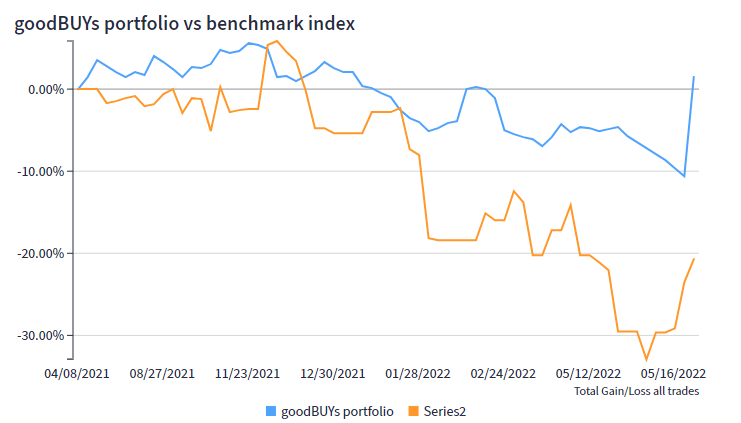

Portfolio Update

In the meantime, the goodBUYs portfolio continues to benefit from recent limited bets on select stocks.

I continue to make risk-adjusted bets on select stocks. The idea is to make use of the rally why we can. It's also a recognition that it's possible to be wrong about the market.

So I'd rather cut a small loss if the market moves lower, than miss out on the potential for a bigger move if the market moves higher, no matter how certain a deeper decline may appear.

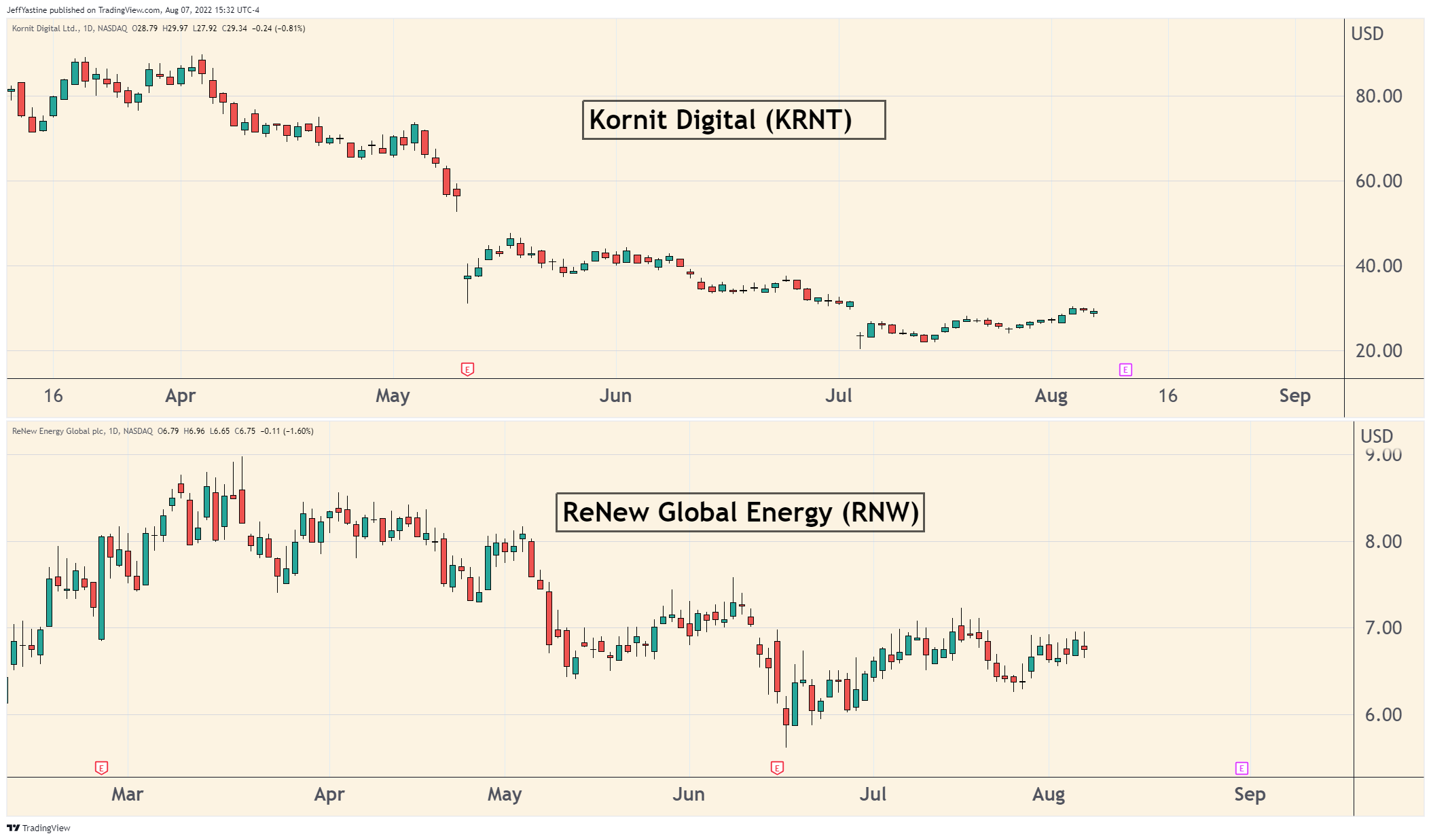

New to the Portfolio

Last week I added 2 new stocks - Kornit Digital (KRNT) and ReNew Energy (RNW). You can read the ideas behind both positions here.

I'll also add an observation...

As hopeful as I might be with these (and our other) stocks - in this kind of stock market, it's helpful to use what are sometimes called "time stops."

In my experience, when I've been right about a stock, it usually happens fairly soon with the stock moving higher.

I've gotten myself into a lot more trouble by waiting as the stock drifts sideways, without really appearing to move lower. Just drifting. Then the bottom drops out at a point I least expect and the real trouble begins.

So if it appears that either of these stocks is a "drifter"...I'll likely exit the positions sooner, rather than wait for them to fall to their "loss price" in the alert ($19 for KRNT, $5 for RNW) real other words, if a stock doesn't start moving higher fairly quickly, in the way we might expect...I'll presume I'm wrong, take the small loss and move on.

Clear Secure (YOU) had a nice week, breaking out from a downtrend line that stretches all the way back to last summer:

It's hard to get too excited about this stock's performance in the short-term...not when I'm talking about the very real threat of an ongoing bear market in the same article. But I think it's worthwhile to respect YOU's double-bottom price around $19-$20 a share as potentially being very important.

While I'm pitching the stock here for its biometric identity scanners to speed our way through airport security lines, there's another reason to keep owning the stock and see what happens (rather than take quick profits).

YOU's bigger goal is to become its own payments platform for retailers. It's already held pilot-testing of the technology with select retailers.

Some day soon, we might only need our face and/or a fingerprint to make a purchase, rather than whip out a credit card or cash.

That kind of service could be very important if retailers are forced by inflation levels and worker-availability to go to cashier-less business models in their physical stores.

Moderna (MRNA) spiked higher at mid-week after beating analysts' expectations.

MRNA generated $4.7 billion in sales for Q2, a 9% gain over year-ago levels. The company earned $5.24 a share for the period. Though that was less than it earned in last year's quarter, it still beat estimates by a good margin.

The stock was dinged a bit on Friday. I presume it's because of a plan by Democratic plan in Congress to allow Medicare for the first time to negotiate volume discounts with drug makers (forbidden until now, with heavy lobbying from Big Pharma companies).

I am tempted to take profits here. We're up nearly 40% on this position. Analysts lowered their profit estimates a bit last week as well.

But if we see more upside movement in the market in the next few weeks, MRNA could move up as well. So let's let it ride for now.

Everspin Technologies (MRAM) was impressive last week as well:

The company reports its quarterly results this Thursday, August 11. I've seen published estimates from analysts projecting losses of between -$0.01 to -$0.04 a share.

If the company surprised analysts with a small profit, that would be yet another signal this company is doing all the right things with its next-gen memory chip products.

Overall, I think the stock will blow in whatever direction the overall market blows. So short-term, I'm thinking higher. Longer-term, it could continue to drift sideways or perhaps lower - as it did from November of last year through July this year - in tune with the overall market. That's a chance we'll have to take for now.

Jeff

Member discussion