Chart(s) of the Week: Europe's COVID Worries

We did some repositioning of the goodBUYs portfolio today based on some market activity I've observed, and news of late.

The charts for airline and cruise line stocks are NOT looking good. I've added the charts for Carnival (CCL) and Southwest Airlines (LUV) side-by-side here so you can see what I'm talking about.

In fact, as you can tell from the red-dotted lines, both groups (all the individual airline/cruise line charts look more or less the same) would only have to fall another 10-12% or so before they would be making new lows for the year.

That's not good either.

All of this might seem perplexing since we're supposed to be coming out of the pandemic, right? We're also heading into the holiday travel season. These stocks should be headed higher, not lower for multiple days, and on the verge of "yet-lower" lows.

What's going on?

Well, if we look at when the stocks last peaked in price, it was Friday November 5, and Monday, November 8...which is when headlines like this one began making the rounds on Bloomberg, Reuters, etc:

In recent weeks, health experts have been tracking a notable "sub-variant" of the Delta COVID virus in Europe that has experts more worried as well.

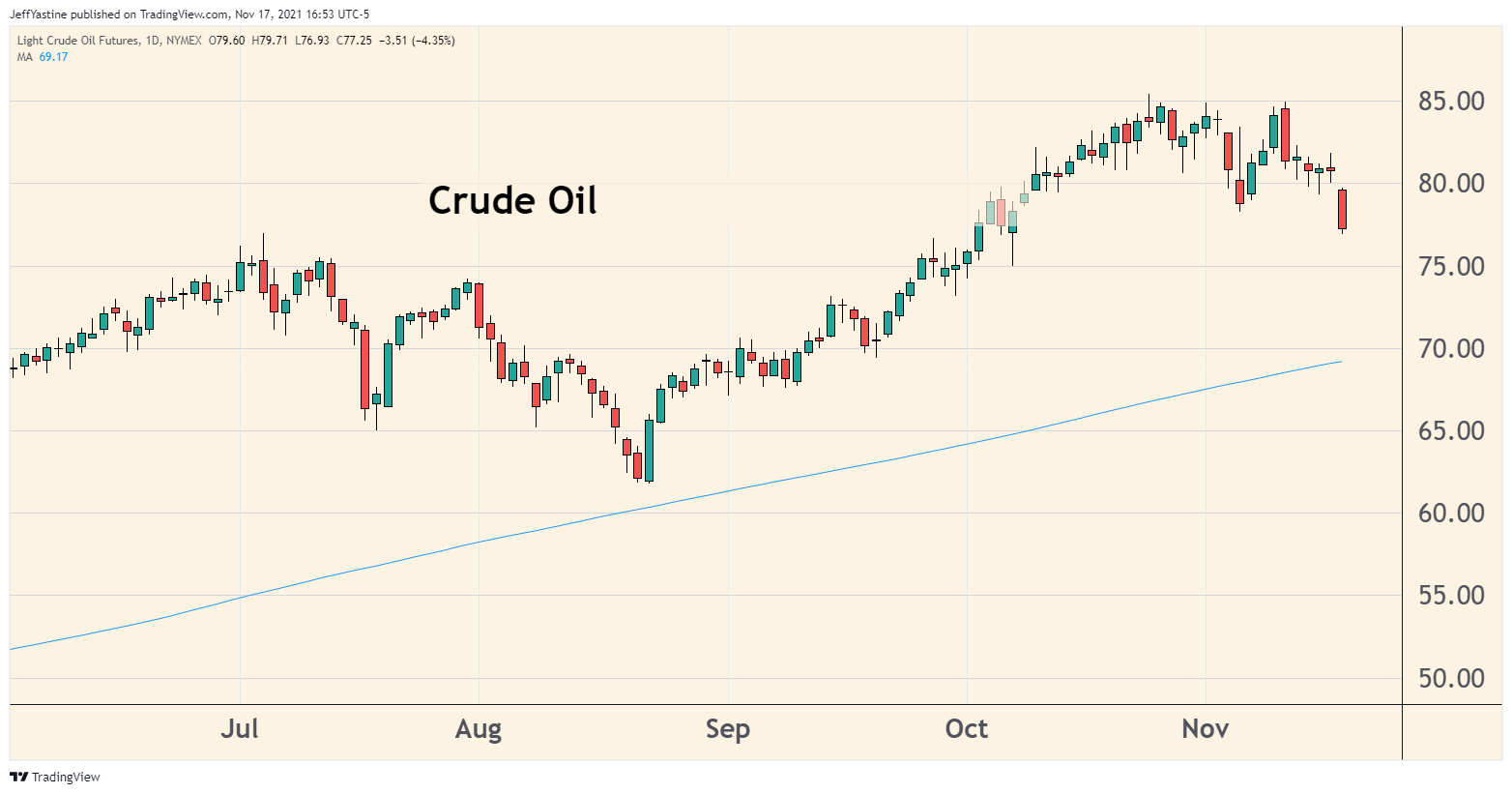

Perhaps more ominously, on November 8 oil prices ran up to $84-$85 in an effort to make a new "higher high" - and failed. Today it dropped to its lowest price since early October:

It's still early, of course. Information travels at the blink of an eye. The impact of Europe's surge, or the importance (or lack of it) with the Delta sub-variant won't be known for a while.

So we have to take all this with a grain of salt.

In the meantime, markets are doing what they always do - "discount" the impact of future events both good and not-good.

Best of goodBUYs,

Jeff Yastine

jeff@goodbuyreport.com

Member discussion