Don't Fight the Fed - Ignore It!

If you haven't been through one of these market situations before, it's enough to make you want to pull your hair out.

The Federal Reserve today will likely raise interest rates at least another quarter-point, or perhaps more (we'll know for sure at 2:15pm ET).

And as the headlines from the last few days show - there's a huge wall of skepticism from Wall Street economists and most investors. To their view, the current month-old rally must be yet another bear market fake-out.

Here's one from Yahoo Finance yesterday:

Here's another from Bloomberg:

And for all I know - they may be right. The broader market might well plunge sharply lower after today's Fed announcement.

But up to this point, the collective wisdom of the stock market appears to believe something else.

The Nasdaq 100 is up 16% from last year's bear market lows, and could hit "new bull market" territory soon, however doubtful we are about its validity or not:

So if you're feeling frustrated - should I be "in" or "out" of this market? - it's OK. I've been there. But I've seen a lot of bear markets and bull markets come and go since the early 1990s...

- I used to fret over being bearish or bullish myself - what if I'm wrong?

- I used to get really hyped-up on "Fed days" like today.

- I used to wait anxiously for all the major economic reports.

- I used to closely read the opinions of major Wall Street strategists.

At some point, I wised up.

"Skeptically" Bullish

I learned - through bitter and sweet experiences - that none of those things listed above really matter.

I realized that I can't succeed unless I choose to put my money at risk. I may feel bearish from an emotional standpoint - like now.

But if the market works its way higher despite my doubts - I must choose to be skeptically bullish or risk being left behind.

- I learned the Fed can raise interest rates - and the stock market goes up.

- I learned that major econ reports can be really bad - and the market goes up.

- I learned that major Wall Street strategists are quite often very, very wrong.

Skeptically Bullish: Explaining & Proving It

Being skeptically bullish means being open to the possibility that I don't know all the right answers.

But I'm willing to take limited losses ("cut your losses and let your winners run") as the price for being wrong. My premium subscribers and I did that a number of times during last year's bear market rallies and may well do so again before this year is through.

But if certain sectors or sub-sectors within a bearish market begin to "act" better, I can't automatically disregard those signals.

So I'll put some money into a few stocks. Days or a few weeks might go by - then I'll add more positions, and then a few more after that.

It doesn't mean I have to commit huge amounts of my portfolio's cash either, at least not all at once. Even now, the goodBUYs portfolio - which has a (theoretical) starting value of $10,000 - is only 50% invested. Yet it's up nearly 20% thanks to the recent rally:

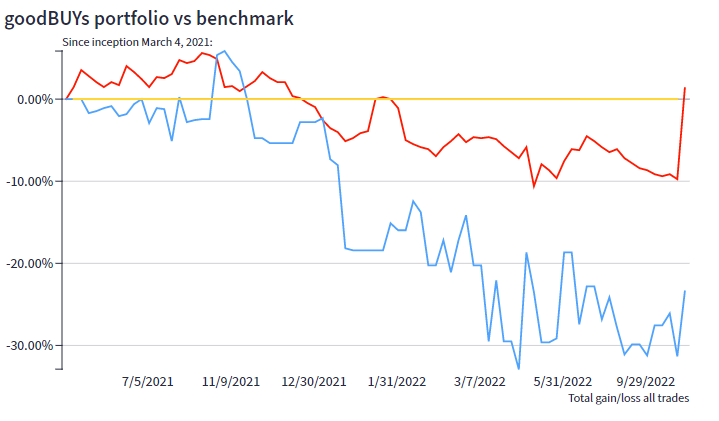

And because of all that, the portfolio continues to outdistance our passive small-cap index benchmark (ISCG) with the same starting value - and recently pushed into the "green" above $10,000 after treading water through last year's difficult environment:

So I'd rather ignore the Fed.

If I use good risk management in my trading and investing choices, it's a lot cheaper to be early - and wrong - than waiting for Wall Street to finally tell me "the water is fine" (after everyone else has already gotten into the pool).

Jeff Yastine

Member discussion