FAQs

Thanks for becoming a subscriber to my newsletter, Jeff Yastine's goodBUYreport!

Free subscriber FAQs are below. Premium subscribers - skip to the FAQ section of the same name below.

Q: How much is a subscription to your service?

A: Basic subscriptions are free.

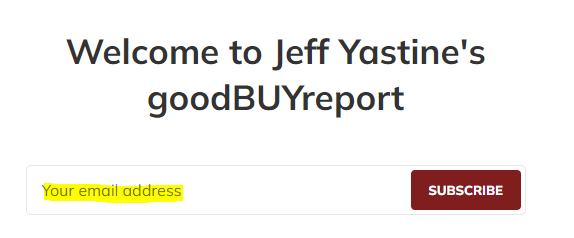

Click this link to sign up for a basic subscription. Enter your email address (like I'm showing in the image below) and you're done!

All you're doing is signing up for my market update emails, published on Sundays and at midweek. I don't sell your email addresses to anyone, and promise not to fill up your in-box with lots of dubious come-ons for expensive trading services by myself or anyone else.

Q: Can I cancel a free subscription?

A: Of course. Un-subscribe at any time.

Just hit the "unsubscribe" link at the bottom of every email, or via the website (for more info, read "Can I Cancel?" below) or just send me an email to take care of it for you.

Q: Do you offer premium subscriptions?

A: Yes! Premium subscriptions are $5 a month or $50 a year.

It gets you access to...

- All stock recommendations in the goodBUYs portfolio now or in the past.

- The always-updating goodBUYs portfolio.

- "The Hidden Formula" interactive portfolio risk worksheet.

- Performance page, so you can see whether I'm beating the market or not.

- Free subscriber articles already posted on the site, of course.

You can become a premium subscriber by clicking here or via the "Subscribe" tab at the top of this page. The cost, as stated above, is $5 a month or $50 a year.

**Stripe is our payments processor, with a portal provided by my website's hosting provider, ghost.org.

Q: Can I cancel a premium subscription if I don't like the service or get cold feet?

A: Yes, cancel anytime.

The first 30 days after paying for a premium subscription is entirely free for you to try out and see if the goodBUYreport is the right fit. You're welcome to cancel through the website (fastest) or send me an email (not quite so fast).

You may also call our customer service line, but for fastest service - send an email instead or cancel yourself via the website.

Q: How do I cancel or change my premium subscription?

A: In 4 easy steps, here's how to cancel a premium subscription yourself, via the website:

Step 1: Click the "Account" tab that's on the upper right corner of every page on this website.

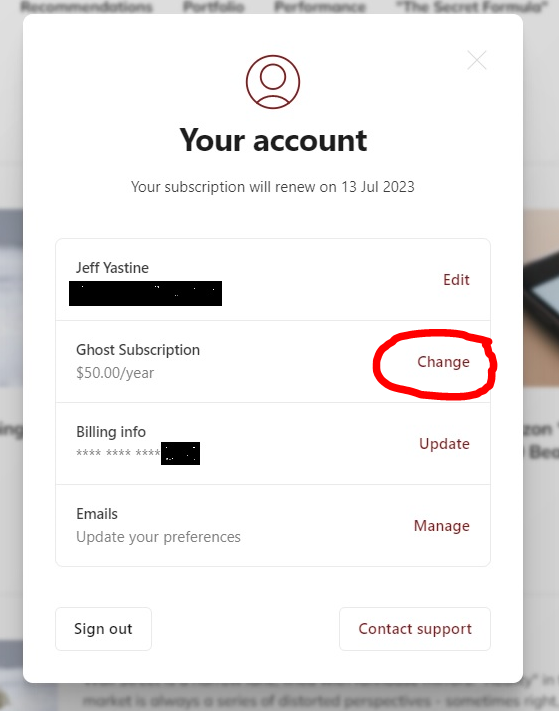

Step 2: You'll see a box pop up like the image below. Click where it says "Change"

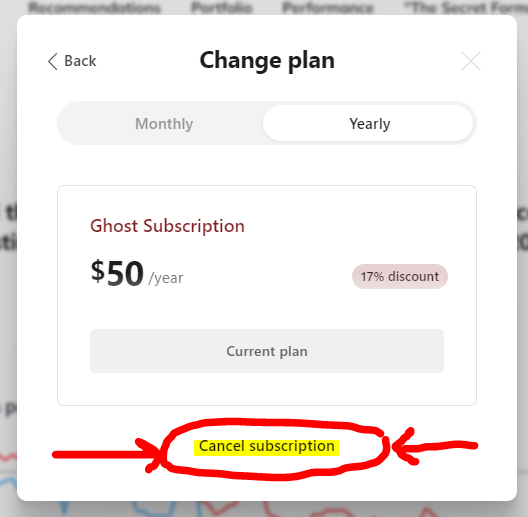

Step 3: You'll see another box appear...hit "cancel subscription" as noted in the image below:

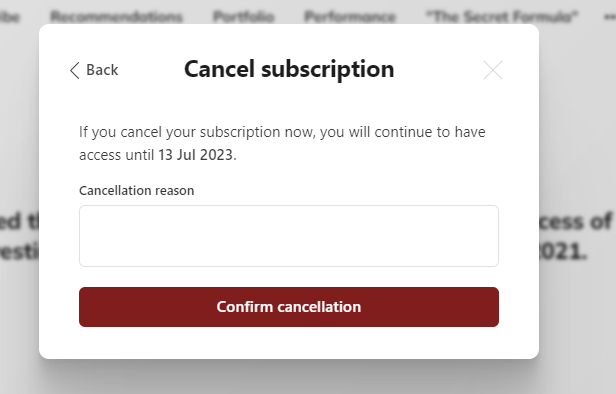

Step 4: You'll see a "Cancel subscription" box where you'll be asked to confirm the cancellation:

That's it. You're canceled (but feel free to re-subscribe at any time!)

Q: How many trades do you issue per month or per year?

A: On average, you'll see 3 to 5 trades a month. But the actual number depends on market conditions.

Here's what all that means...

Some weeks and months we have a lot of trades, with fewer (or occasionally, no trades) if the market just isn't cooperating (i.e. heading lower).

I just don't think it's right for me to "recommend" a stock to anyone if I don't think it has a decent chance of going up at the time I recommend it.

But if you're patient, you're going to get a lot more trades than you asked for - and in my opinion, with better results much of the time as well.

For example:

January 2023: I recommended 7 stocks within a handful of days because I believed stocks were setting up for a sharp tradeable rally.

For 2022: I recommended nearly 60 stocks as the bear market gave us steep declines and brief sharp rallies. That works out to 4 to 5 trades a month.

I finished the 2022 bear market year with a (-10%) loss in the goodBUYs portfolio, while our smallcap benchmark fell (-30%) for the same time period.

For 2021: With 10 months of publication, I recommended 33 stocks, an average of 3 a month.

I finished 2021 with a 2% gain in the goodBUYs portfolio while our smallcap benchmark fell (-3%) as an emerging bear market first began to put pressure on small stocks.

Q: Is the goodBUYreport a trading service or an investing service?

A: It is both.

I have subscribers who tell me they "swing trade" my recommendations - buying now and selling a few days or a few weeks later. I have other subscribers who are clearly long-term investors. Everyone makes their own decisions and reaps (or rues) the results.

But the way I view all this is to call myself a "long-term trader"...

In other words, my goal is to "trade into" a stock so that - ideally - I have a profit in the stock almost right from the start. It doesn't always work out that way, of course.

But I don't want to spend many weeks, months or years owning a stock at a loss because I'm convinced ,that it will eventually go higher.

I print specific "Buy" instructions and "Sell at a loss" target prices.

In trading and investing, time IS money. The longer we spend in a stock that doesn't yet show a profit for us, the more time we lose putting that money in another stock that could show better results, faster.