"Fed Day" & What I'm Watching For

This afternoon around 2pm ET, the Federal Reserve will announce its latest decision about interest rates.

As usual, there's a lot of betting going on - whether the central bank will raise rates again or not, and whether the Fed may signal that its "done" on the rate-hiking cycle which started roughly 18 months ago...or not.

There's so much betting - "pre-positioning" going into these "Fed Day" events - that you can't really trust the stock market's initial reaction. After the announcement, we'll often we'll see a thrust in one direction, only to be met by an equal counter-thrust in the other.

So these things sometimes take a day or two to settle out. But more so than the Fed announcement itself, what I'll be watching for in the next few days...are the reactions (if any) from interest-rate sensitive stocks, and from small-cap stocks.

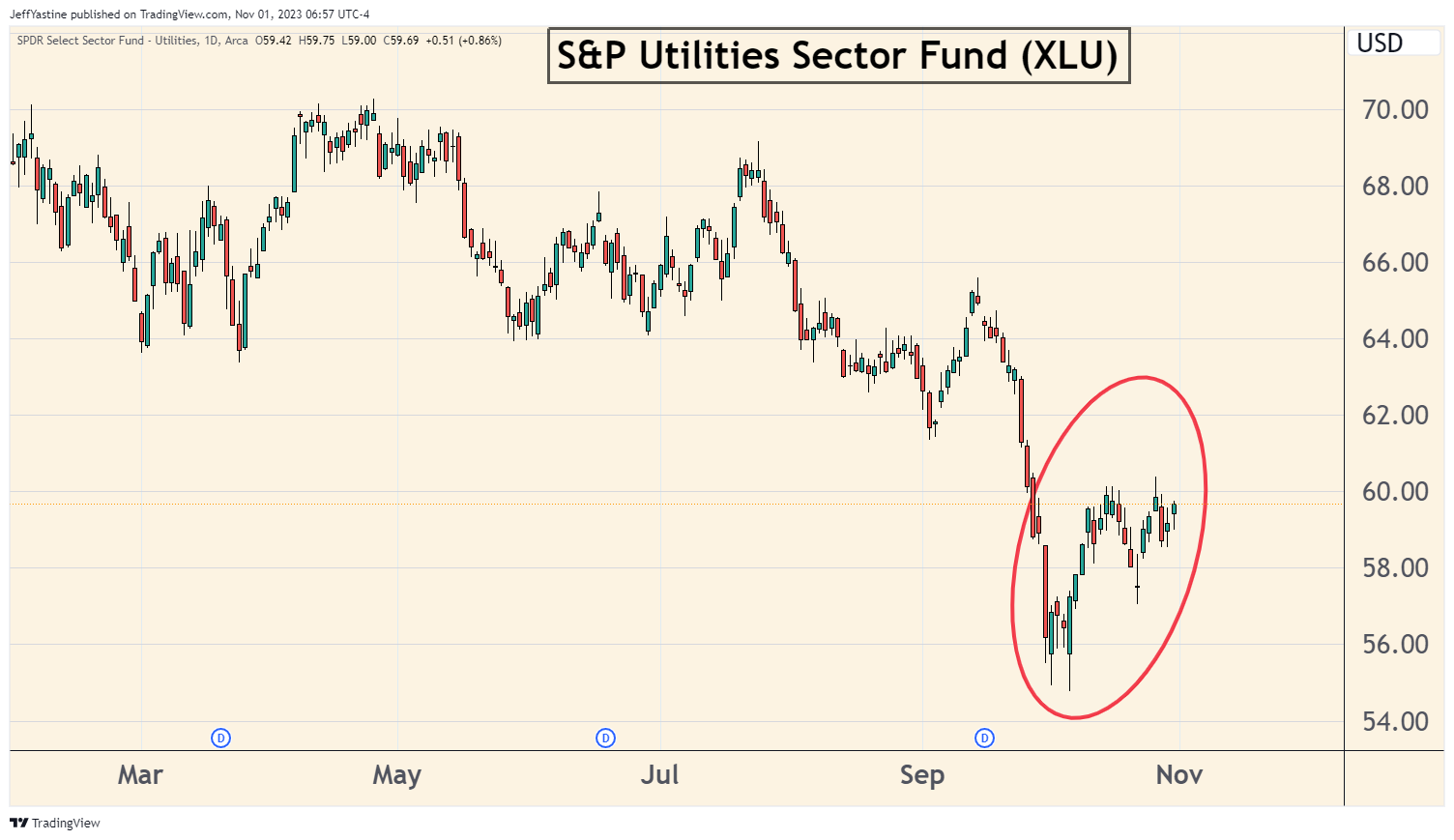

Utility Stocks

For example, utility stocks are interest-rate sensitive. These stocks are down roughly 25% in the past year as the Fed hiked rates. But in recent weeks, the sector has started to perk up (even as the overall market has weakened):

So I'd like to see these stocks continue to work on building the "base" in the chart, with the idea that investors are anticipating no more rate hikes by the Fed, even if the central bank isn't explicit about that idea in today's announcements.

Airline Stocks

Another sector I'll be watching carefully are travel stocks...airlines especially. This group was already beaten up by rate hike fears, but also concerns about labor costs and worries about fuel costs.

After a 35% drubbing since July, travel stocks are ripe for a bounce at least, and the aftermath of today's Fed meeting could provide some clues as such:

I know we all read plenty about consumer indebtedness. But I've learned never to doubt people's ability to spend money when they really want. And with the holiday travel season ahead of us, I can imagine a lot of folks wanting to get on airlines to visit loved ones...with airline stocks rising in advance of such a holiday trend.

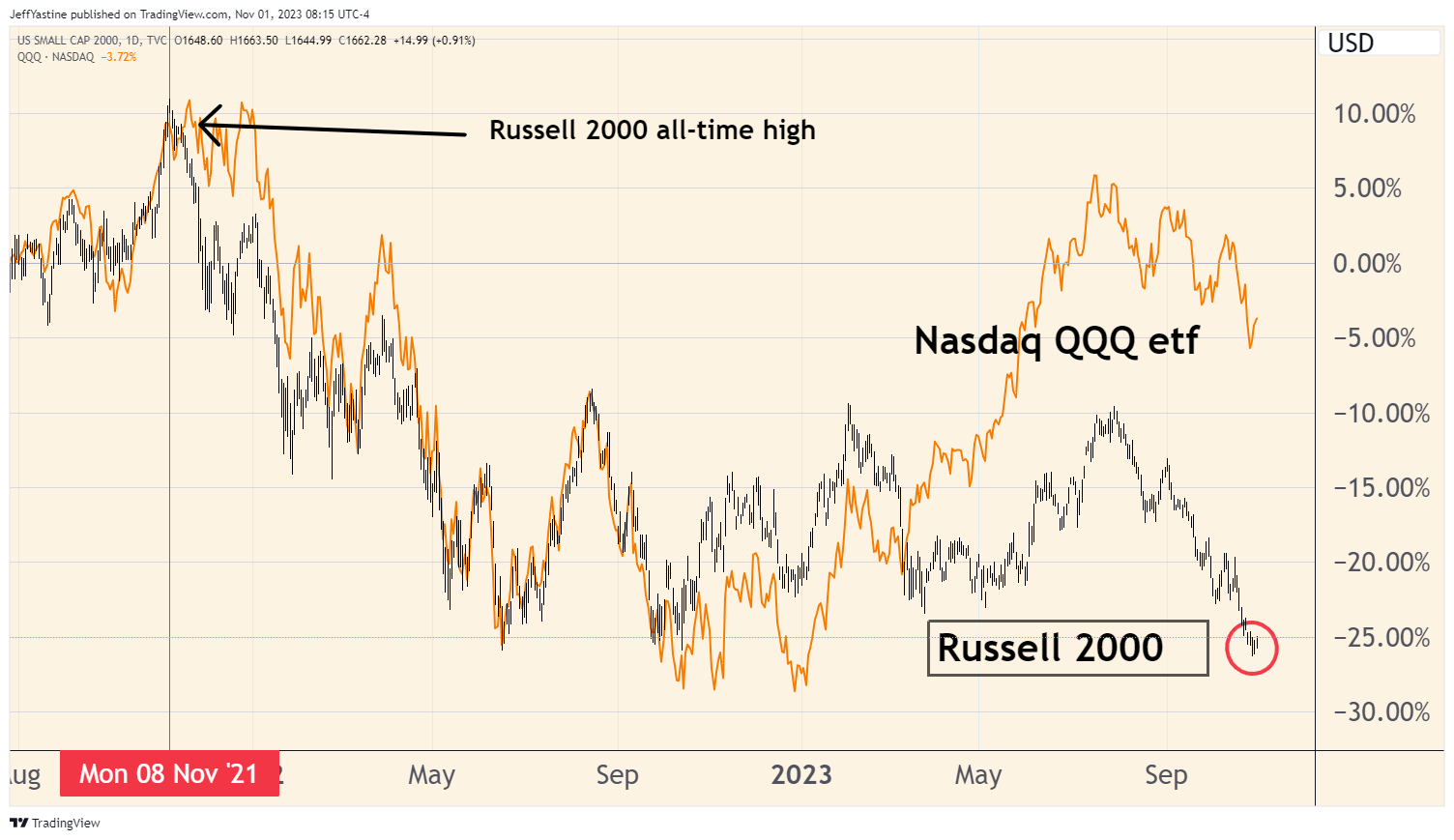

Watching Small Caps

Lastly, I'm curious if small-cap stocks - battered in waves for two years (months before the Fed actually started hiking interest rates in 2022) - can pick themselves up off the mat:

The broader market rally that started in April and May has largely left small-cap stocks far behind. They've barely participated. So a sudden "perking up" of small company stocks would be a helpful indicator that a post-Fed rally may have some staying power.

Best of goodBUYs,

Jeff Yastine

Member discussion