Final Note for the Trading Week

Unless there's a late day rally to salvage today's session, Monday could be ugly.

I'll have more to say about all this in the Sunday update.

But my point in today's note is to suggest not getting too resolutely bearish at this point.

If the major indexes need to carve out a "double bottom" to finish this decline, we might be a lot closer to the end than many suspect.

Just from what I'm seeing in today's drip-drip-drip selloff, lots of folks are in "capitulation mode" - which means a real bottom may not be far away.

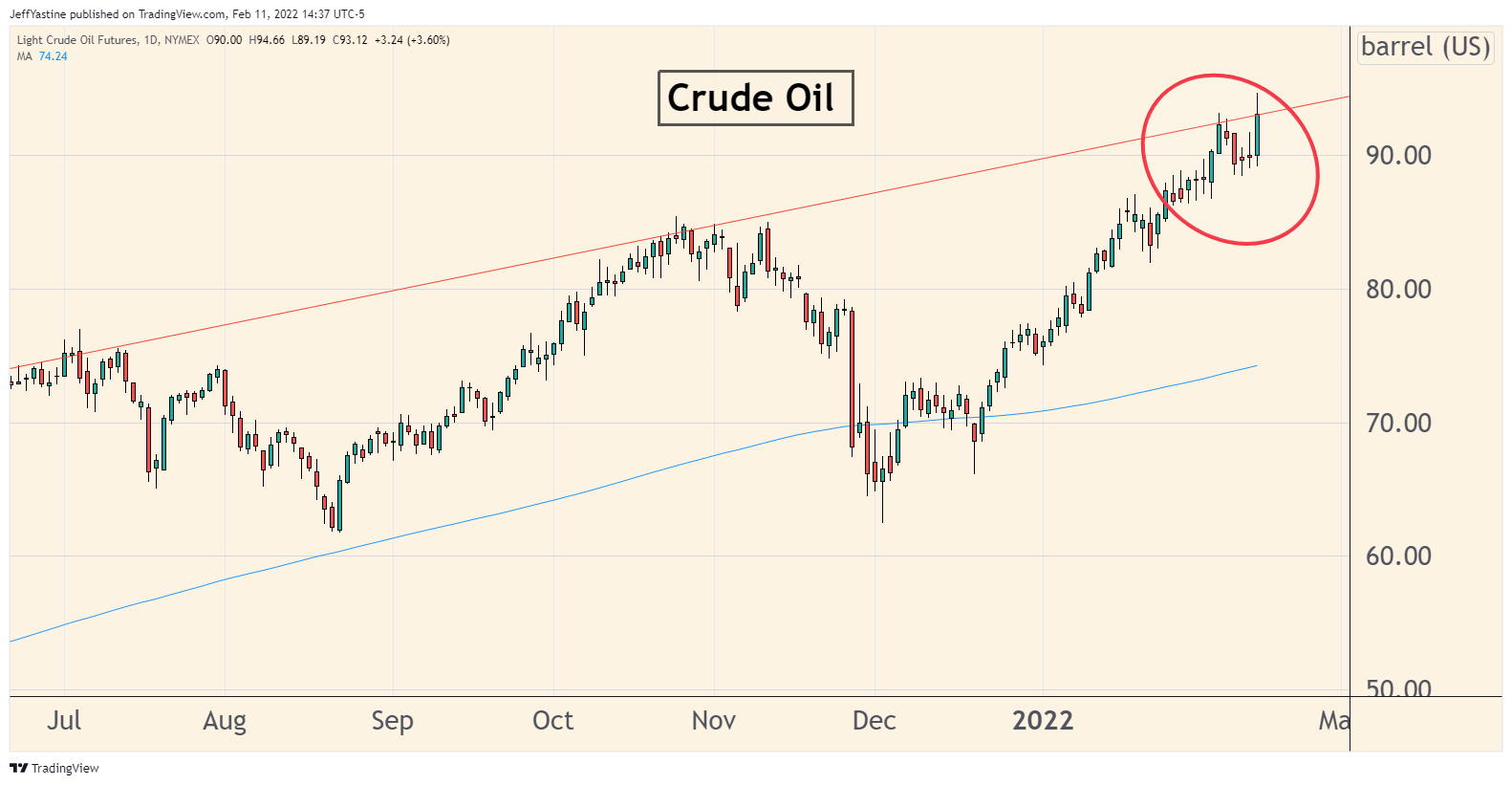

Lastly, what about oil prices? They're up more than 3% today to new 7-year highs:

No doubt we'll see lots of screaming headlines on the Monday morning news programs about inflation (on top of this week's CPI report about price trends being at 40-year highs).

Just remember that prices, almost by definition, reverse when we least expect.

From that perspective, the rise in oil prices could well turn out to be the proverbial "crowded trade" where everyone buys in at the top.

I think there's perhaps a 70% chance that we're looking at a near-term top in oil prices in coming days, with huge bullish implications for stocks obviously.

- This article in an oil-market blog lays out some interesting contrarian ideas about the possibility of lower - not higher - oil prices in coming months.

- US-Iran nuclear talks have re-started. The talks are rife with pessimism. But even the rumor of a breakthrough would knock the wind out of the oil market rally.

Yes, the Ukraine-Russia situation is hanging out there as a wildcard.

But I can't help but be reminded of 1991, watching oil prices soar as US and allied forced prepared for Operation Desert Shield.

Once the shooting started, oil fell 30% in 10 trading sessions, and 50% over 3 months - even though the repairs to Kuwait's network of blown-up oil wells and pipelines would take many months to put back online.

See you on Sunday.

Jeff

Member discussion