Fishing for Market Profits

Before talking about the stock market, let me state a personal factoid:

I'm a lousy fisherman.

But recognizing that - helped make me a successful investor and trader.

See, in the early 1970s, my family moved from the 'burbs of northern New Jersey to the swamps of southwest Florida. Our new hometown had no shopping mall. No interstate highway.

It was a place so small that our version of fast food was a local chain called Burger Queen (which made for a big laugh from my snarky big-city cousins when they came to visit).

But we did have plenty of water - pristine creeks, rivers, and bays.

And everyone seemed to be an expert fisherman except me. My school buddies came home with snook or snapper - fun to catch, and good to eat.

I'd come home empty-handed - and complaining loudly about my terrible luck.

Success = Details

Long story short, eventually I realized my poor ability as a fisherman had little to do with luck.

My school buddies fished in the same waters I did. They had the same gear.

But they paid attention to a million little things.

The time of day, tide levels, water temperature, water clarity mattered. So did whether they were fishing in bright sun or overcast skies, wind or no wind, using live bait or plastic lures. You get the idea.

Me? I just threw my baited hook in the water and that was that.

The stock market is a similar game.

The devil is in the details - which you don't always hear on social media or CNBC.

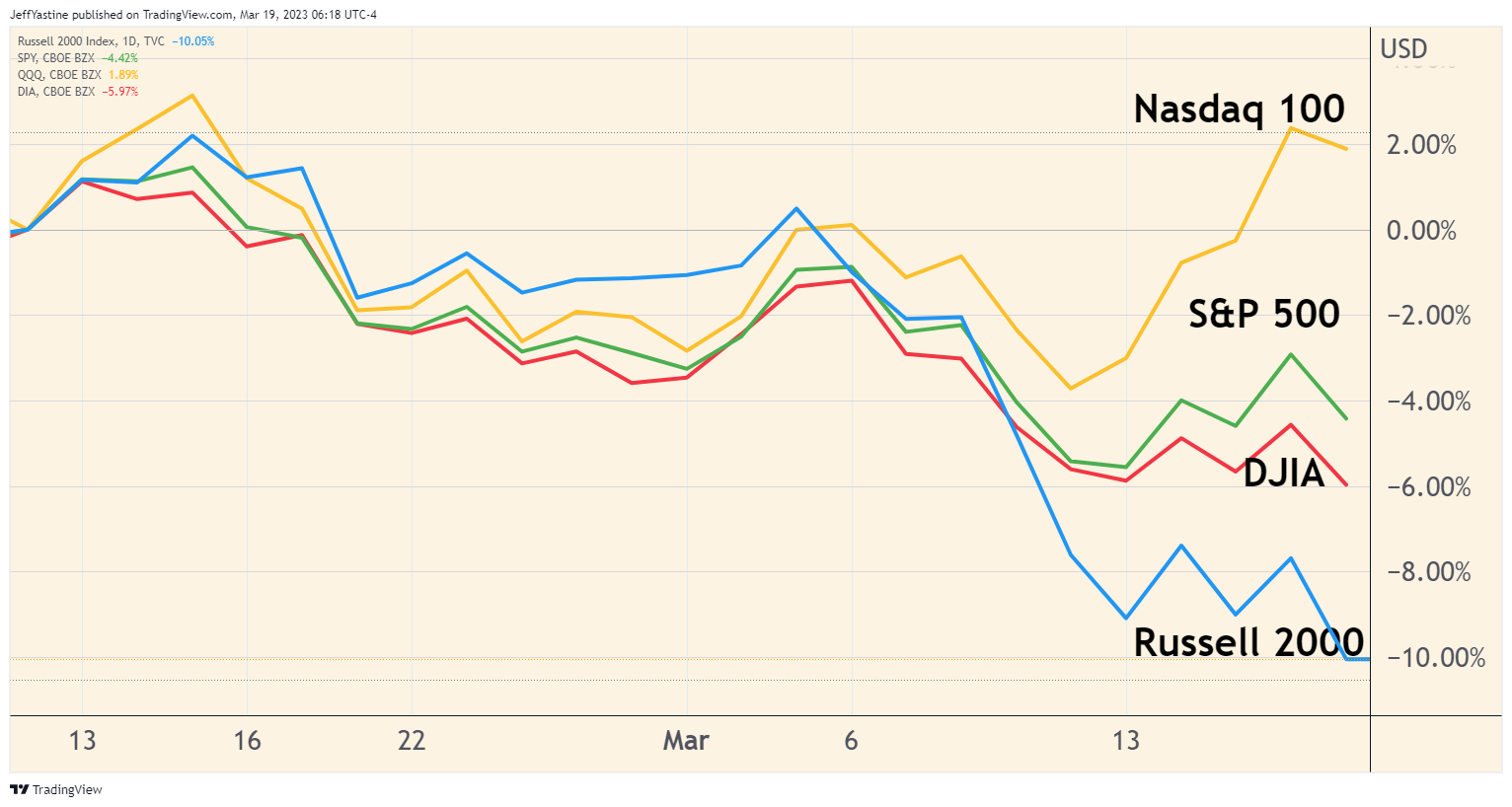

For example, last week saw a very nice rally in many Big Tech stocks. Quite impressive actually. It brought the Nasdaq index nearly back to the hopeful highs of early February:

- Credit Suisse (CS) and UBS (UBS) announced a bank-rescue deal on Sunday afternoon, which will calm the jangled nerves among the bankerati.

- Some think large tech stocks like Meta (META) and Microsoft (MSFT) are an (arguably) good value.

- Hope that the Federal Reserve - meeting this Tuesday and Wednesday - will throw some good news our way.

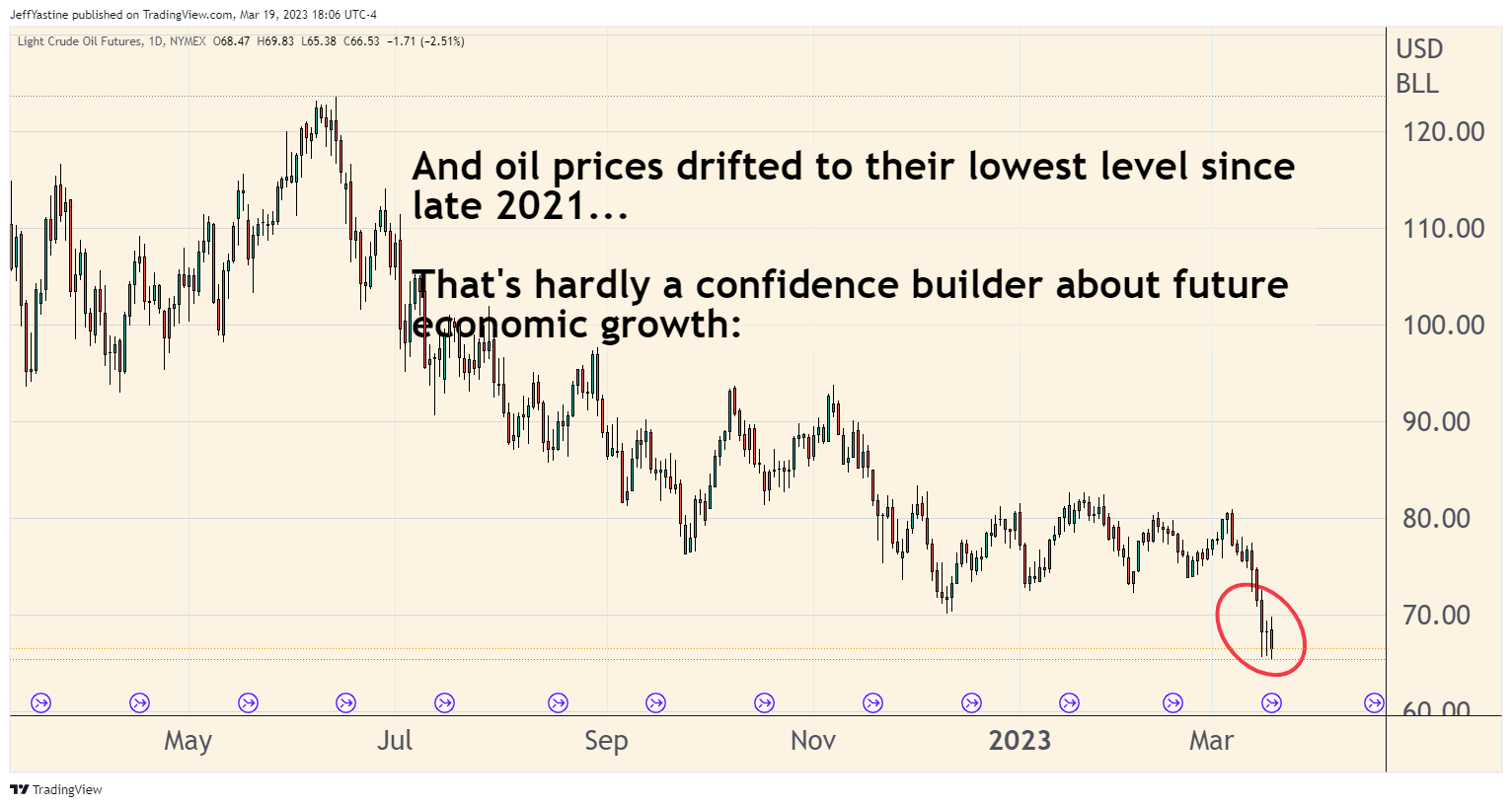

But one thing that ought to bother everyone is that since the start of the tech rally a week ago, the rest of the stock market isn't following the Nasdaq's lead.

Whenever one index goes up in a significant way, and the others go down...it's usually not a healthy sign:

One of the only other market sectors that did really well last week...were the ones I mentioned in last Sunday's message:

- Gold, which rose 6% for the week

- Gold-mining stocks, which jumped more than 11% for the week:

Growing Fears, Rising Stock Prices (for now)?

That doesn't mean the main stock indexes can't continue to move higher from here.

Maybe tomorrow, all the other indexes play catch-up and rocket higher. Or the Fed, fearing more banks will go under, pauses on additional rate hikes and Wall Street celebrates with another big happy party.

Seems unlikely, but hey, crazy stuff happens when we least expect - especially on Wall Street.

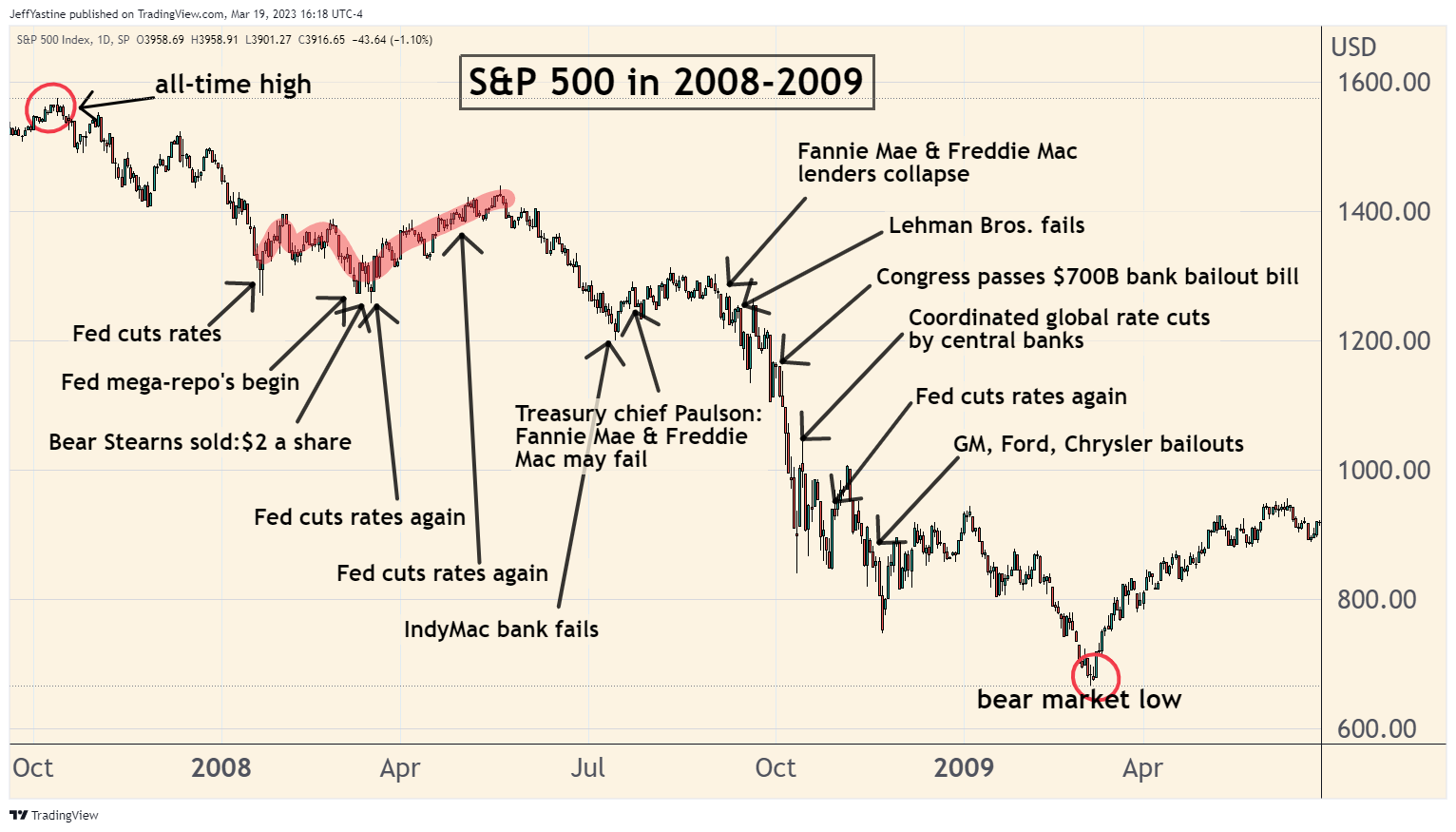

That's why I posted the chart below on my Twitter feed last week.

I'm not predicting another 2008-style financial crisis (although it could happen). But look at the red-highlighted part of the timeline:

Lots of very negative things were happening - record foreclosures, and Bear Stearns collapse. The Fed was cutting rates and injecting billions into the banking system to prop up confidence.

And for a time it worked. The S&P 500 rose nearly 10%, and the Nasdaq (not shown in the chart above) rose more than 20% between March-May 2008.

It took another 6 months, until September 2008, for the real collapse and panic to begin.

The point being...

We may continue to see a steady drumbeat of bad news - and the market could grind its way higher anyway. Or at least not go down.

Don't let that surprise you if it does - or blind you to the potential dangers still ahead.

As always, the odds of ultimate success are knowing the details.

Best of goodBUYs

Jeff Yastine

Member discussion