New Stock! The Undervalued Vaccine Maker Hiding in Plain Sight

A reminder...the goal with this portfolio is not specifically to trade for a quick buck (although we'll see plenty of that, no doubt). It's really about education, learning and seeing for yourself the benefits of smart, risk-based investing and speculating in the stock market.

The whole point of investing and trading is to make money, of course.

Not to sound overly dramatic, but it's also about survival...survival of our portfolios and self-confidence through strings of bad luck, bad stock ideas or a bad market.

If you can watch me do it here at the goodBUYreport, I think it will give you the confidence to pursue your own financial goals through the stock market.

Lastly, I’m not a registered broker or financial advisor. I’m a self-taught trader who’s made and learned from lots of mistakes - and successes - along the way (but with investing and speculating, you learn the most from your mistakes).

So let’s get on with the first stock to go in the portfolio!

Almost everyone is familiar with the company these days…

Moderna (MRNA).

I believe the stock has a good chance of doubling from the current price over the coming year.

In my opinion, it’s a heavily undervalued stock. It’s going to earn a lot in profits this year and next. The share price, in my opinion, is too low and doesn’t reflect the profits that are about to gush into the company’s bank account.

In addition, there’s a lot more to Moderna’s business than just producing its COVID vaccine. There’s a slew of other drugs in the pipeline.And finally, researchers continue to discover new, somewhat disturbing variants of the coronavirus. This is a hard virus to stamp out.

But Moderna’s technology makes it possible to quickly and accurately target these variants with modified vaccines. Which means that growth of Moderna’s business - just supplying the covid vaccine for years to come - is likely going to be a lot bigger than most on Wall Street realize.

Rising Profit Estimates

The last time I talked about this stock publicly was back in early January when it had sold off, trading at $104 (after hitting a high of $175 just a month earlier). I taped a video (which you can watch by clicking here) where I said Moderna’s shares were undervalued.

The stock soared roughly 50% over the next 6 weeks. That was great to see - but I don’t expect such a quick reaction this time around.

But here’s the important point to remember...

Back when I taped that video in January, analysts expected the company to generate around roughly $10.37 a share in profits for 2021, with a slightly smaller level of profits for 2022.

Since then, those same analysts have roughly doubled - yes, doubled - the size of Moderna’s annual per-share profit estimates for both years.

So the recent selloff in the stock from $180 gives me yet another chance to buy the stock while it’s down.

So here’s a key reason why I think shares of Moderna - trading below $150 a share as I write this - are undervalued...

Analysts now expect ongoing vaccine sales to help the biotech earn as much as $23.66 a share in profits this year, and earn a still-considerable $16.69 a share in 2022.

So why isn’t the stock - after hitting a high above $180 in February - soaring even higher, instead of selling off?

I think this is where there’s a disconnect. Wall Street still thinks of Moderna as a “play” on COVID. Once the vaccines go into our arms, the problem is over with.

Traders can go back to forgetting about Moderna and trading tech stocks or whatever instead.

But clearly the COVID vaccine is going to be with us for a longtime. According to the CDC, there are multiple variants in circulation. Some may make us more vulnerable to reinfection. Others appear to spread more easily from person to person than the “original” virus. Another, recently identified in Italy, appears to spread more easily among children.

By some estimates, the pandemic may be with us until 2023 or 2024. It’s also possible that we’ll all need some kind of COVID booster shot periodically to keep our immunity levels intact if the virus continues to mutate.

So in my view, I think there’s a good chance that analysts are underestimating what Moderna’s profits will be not just in 2022, but into 2023 and beyond. My bet is that company’s earnings per share will likely be far larger in those years than current Wall Street forecasts.

The “RNA Platform”: More Drugs in Moderna’s Pipeline

I also believe investors are looking straight past the real longterm value of Moderna’s business, which is its revolutionary RNA-based platform to rapidly create and test all manner of vaccines and drugs.

The focus on Mrna - the set of instructions in our cells which make all proteins and send them to various parts of the body - is a fundamentally different approach to treating disease than other drug classes.

MRNA medicines take advantage of normal biological processes to express proteins and create a desired therapeutic effect. This enables the potential treatment of a broad spectrum of diseases, many of which cannot be addressed with current technologies - and at a breadth, speed and scale not typically associated with the slow pace of typical Big Pharma drug development.

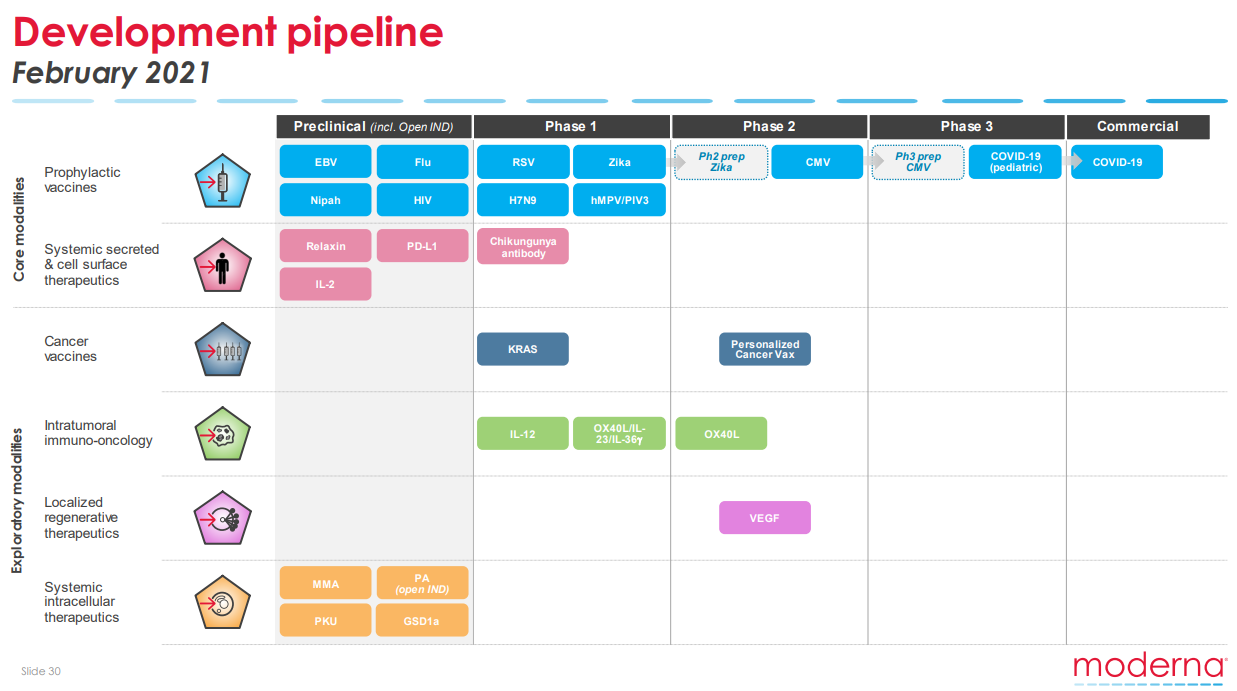

With that in mind, Moderna has a number of other important vaccines and drugs in its pipeline:

- CMV (Cytomegalovirus) vaccine - entering Phase 3 drug trials (last stage before FDA approval and commercialization).

- Zika vaccine - entering Phase 2 trials

- HMPV vaccine (human metapneumovirus) - Phase 1b

- RSV vaccine (respiratory syncytial virus) - Phase 1

- Flu virus - announced January 2021

- HIV (human immunodeficiency virus) - announced January 2021

Moderna is also in collaborations with other major drug companies, including…

- AstraZeneca - Phase 2 trial of VEGF (formation of blood vessels)

- AstraZeneca - Interleukin-12 (cancer treatment)

- Merck - KeyTruda cancer therapy

- Merck - KRAS cancer virus mutations

Source: Moderna Feb 2021 presentation

So that’s my case for the strength of Moderna’s business.

Why do I think the stock is undervalued?

Let’s go back to those earnings estimates. As I noted, Moderna is on track to generate more than $24 a share in profits this year.

Let’s take the price per share of the stock (around $139 as I write this)...and divide it by those forecast earnings per share.

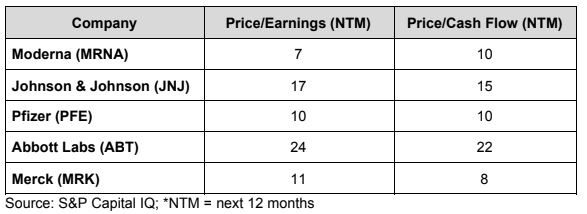

If we do the math, we get what’s a price/earnings ratio or “multiple” - of 6.That’s just far too cheap.

Like bargain-basement, can’t get any lower, practically-giving-it-away cheap, in my opinion.Investors typically assign P/E multiples based on the expected growth rates of a company’s profits. A company growing its profits at 30% a year typically has a P/E ratio of somewhere around 30, and so on.

To give you some perspective on this, let’s compare Moderna’s P/E value against its Big Pharma competitors and near-competitors:

Buying the Stock

The numbers in the table above are the key reason why I continue to believe that Moderna’s shares are undervalued. It’s why I think the stock could double from present levels over the next 12 months.

Sometimes people can’t believe a stock can truly get so cheap. We live in the age of the internet. We have information available to us at all times. So if a stock is cheap, there must be a good reason.

Sometimes there is, and sometimes not.

On Wall Street, every stock has a narrative...a story...attached to it. Traders don’t have time to give long ponderous reflection on stocks. With Moderna, I think the narrative is...it makes a COVID vaccine. The vaccine is going to end the pandemic, and with it goes Moderna's chance for sustainable profits in the future.

My bet is that Wall Street will be forced to reassess that story about Moderna in the coming year.

With all that said, you might be asking - if MRNA is such a good company to own, why are they shares down 30% in the past month (since hitting alltime highs in February)?Yes, we always have to consider the idea of risk - losing money - when it comes to owning stocks of any kind.

But consider something else - Moderna's shares, if you study its stock chart, go through periodic corrections on a regular basis, almost like clockwork - before advancing higher.

As the chart shows, Moderna's shares have had 3 corrections just in the past year, in May-June, and July - September last year, and again in late December - each retracing of almost exactly 40% of the prior move - before running to new alltime highs each time.

The current selloff has taken the shares down 30% so far. If I'm right - especially considering the sharp increase in per-share profits expected by Wall Street analysts - there may not be further to go before the stock begins a new run higher in coming months.

Jeff Yastine

Member discussion