Market Update: Answering Your Emails

This seems like a good time to answer a great email received from my subscriber friend Amir just before the Thanksgiving holiday, so here goes without further ado...

Jeff, I notice you're not predicting as much about the stock market recently. Do you think stocks are likely to go down or go up through February? Much regards, Amir.

Amir, you're right about me refraining from predicting the market in recent posts. That's mostly because I've been wrong, as noted in past weeks. I expected the market to keep moving lower, as it did through most of October. But instead of getting a deeper break, the opposite happened - a huge rally.

When that sort of thing happens, a wise investor re-assesses. So I'm going to duck the question and just say I'm "enthusiastically neutral" about the next few months.

Historically, this is a bullish time of year. So could stocks be higher through February? Sure. Stocks tend to rise, or at least not go down very much - except in a handful of periods like 2000, and in 2008. I thought that we might see a similar template play out for 2023, but clearly that was wrong.

If this is the real thing - "new bull market" and all that - then we should see the rally broaden out, and numerous other groups of beaten-down stocks begin to move higher. So that's I'm keeping my focus.

But could this be another fake-out market rally that fades in a handful of months? Sure.

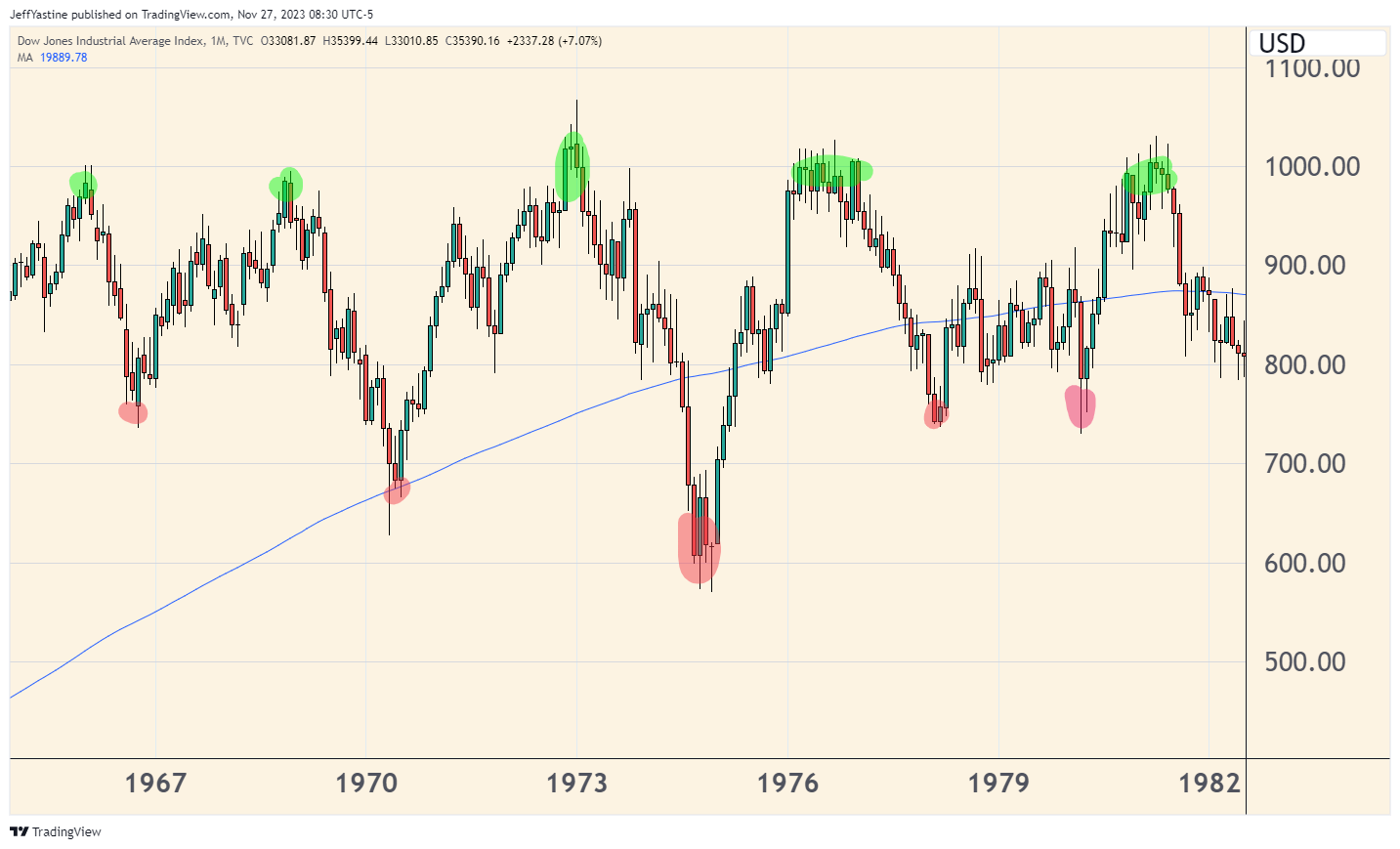

Let's set aside fundamental considerations like interest rates and the economy - and just take a look at a chart of the DJIA or S&P 500 from the late 1960s through early 1980s (below).

Like now, it was a period of high inflation and a general trend towards higher interest rates (which would peak at 20% in 1980).

Over a 15-year period, this market era featured 5 steep bear markets of roughly 20% or more - and a similar number of monumental recovery rallies of 30% to as much as 70%!

But if we average out the highs and the lows, the indexes gained zero ground for a decade and a half.

I have no idea if we're facing a similar period ahead of us or not. But I think it's an important concept to keep in mind, and to stay grounded as an investor. Just because the market has "recovered" and is close to new all-time highs - does not necessarily mean it will keep trending higher and higher in the years ahead.

So when we talk about the stock market these days, that's I'm trying to stay enthusiastically neutral - and keep my crystal ball in the closet, gathering dust!

Best of goodBUYs,

Jeff Yastine

Member discussion