Market Update: How Much Higher?

Trying to figure out the stock market these days reminds me of a childhood adventure...

But if I tell you the story, you have to promise not to report me to the US Department of Transportation or the US Coast Guard, OK?

When I was 8 years old, I got to steer - for real - the Statue of Liberty Ferry, for its 15-minute journey from New York's Battery (at the tip of Manhattan) to the passenger dock at Liberty Island:

Yes, it all happened under the watchful eye of the vessel's captain (a friend of my dad's). But even in the early 1970s, an 8-year-old steering a fairly large vessel across the busy shipping lanes of NY Harbor - with a few hundred people aboard...well, it's not exactly in keeping with regulations.

But a grand adventure for me, nonetheless.

The captain had me grasp the ship's wheel, and noted just above it, the "rudder angle" indicator numbered from 0 to 40. Once or twice a minute he'd say "OK Jeff, give me 3 degrees left" or "Steer 2 degrees right" - that sort of thing.

I quickly found that, as hard as I tried, I could not steer the ship in an exactly straight line.

As the captain and my dad explained - the NY harbor currents, prevailing winds, and the wakes of passing tugboats and freighters - they all interact on the ship's hull to push us slightly off-course.

That's why the captain had me make small adjustments on our 15 minute voyage to Liberty Island.

The point being - there was the desired path of the ship (marked by a handful of navigation buoys as I recall), and because of the environmental factors listed above -the reality of the ship's path.

Which gets us to the stock market...

In the past few months I've been pointing to large price gaps in the charts of the QQQ Nasdaq etf (the largest 100 tech stocks by market cap) and more recently, the Nasdaq Composite Index (which is composed of more than 2,000 stocks).

Both of those gaps are now filled:

Yet the indexes show no inclination for reversing course, and moving lower (which is the classic idea behind price gaps as a potential reversal indicator).

So we need to "adjust our course"...

My belief is that we will see the Nasdaq Composite index approach the index's previous all-time highs sometime in the coming month. I believe we will almost certainly see the Nasdaq 100 (QQQ) hit new all-time highs sometime in coming weeks.

As you can see from the chart, the index only needs to climb about 4% higher from current prices:

There's no use arguing whether there's a new bull market or not. From the standpoint of the Nasdaq and S&P 500, that's clearly the case - owing to the so-called "Magnificent 7" of Nvidia, Microsoft, Meta, Apple, Amazon, Netflix and Google.

We've done well in the goodBUYs portfolio riding this "new bull" with everyone else.

But it's still the strangest (and to me) most suspect new bull market ever.

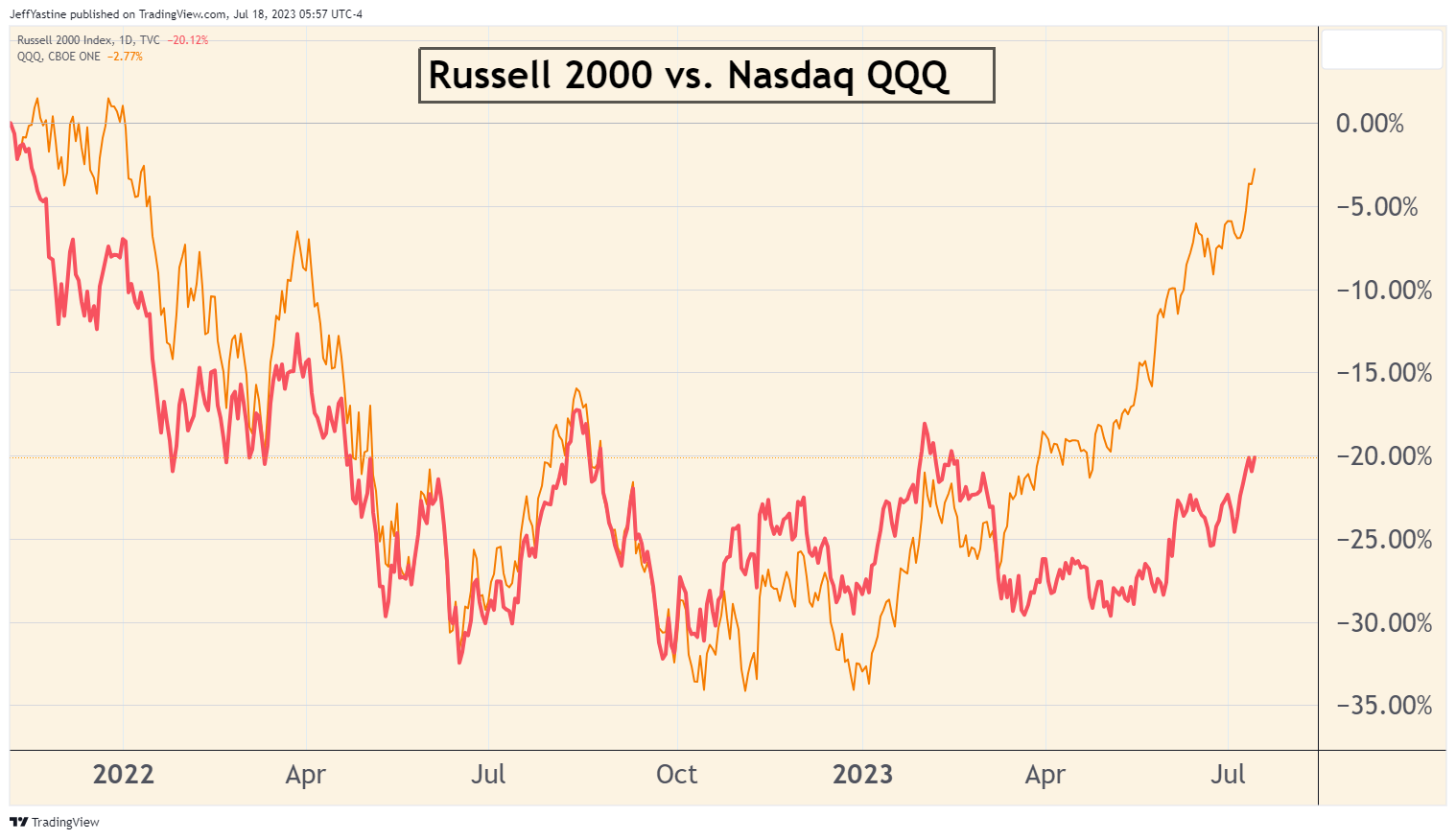

Real bull markets are about trading and investing in riskier (but faster-growing) stocks. Yet this market has left its "superstar stocks of tomorrow" - represented by the Russell 2000 smallcap index - far behind in the dust:

And don't get me started on all the other reasons why we should remain suspicious.

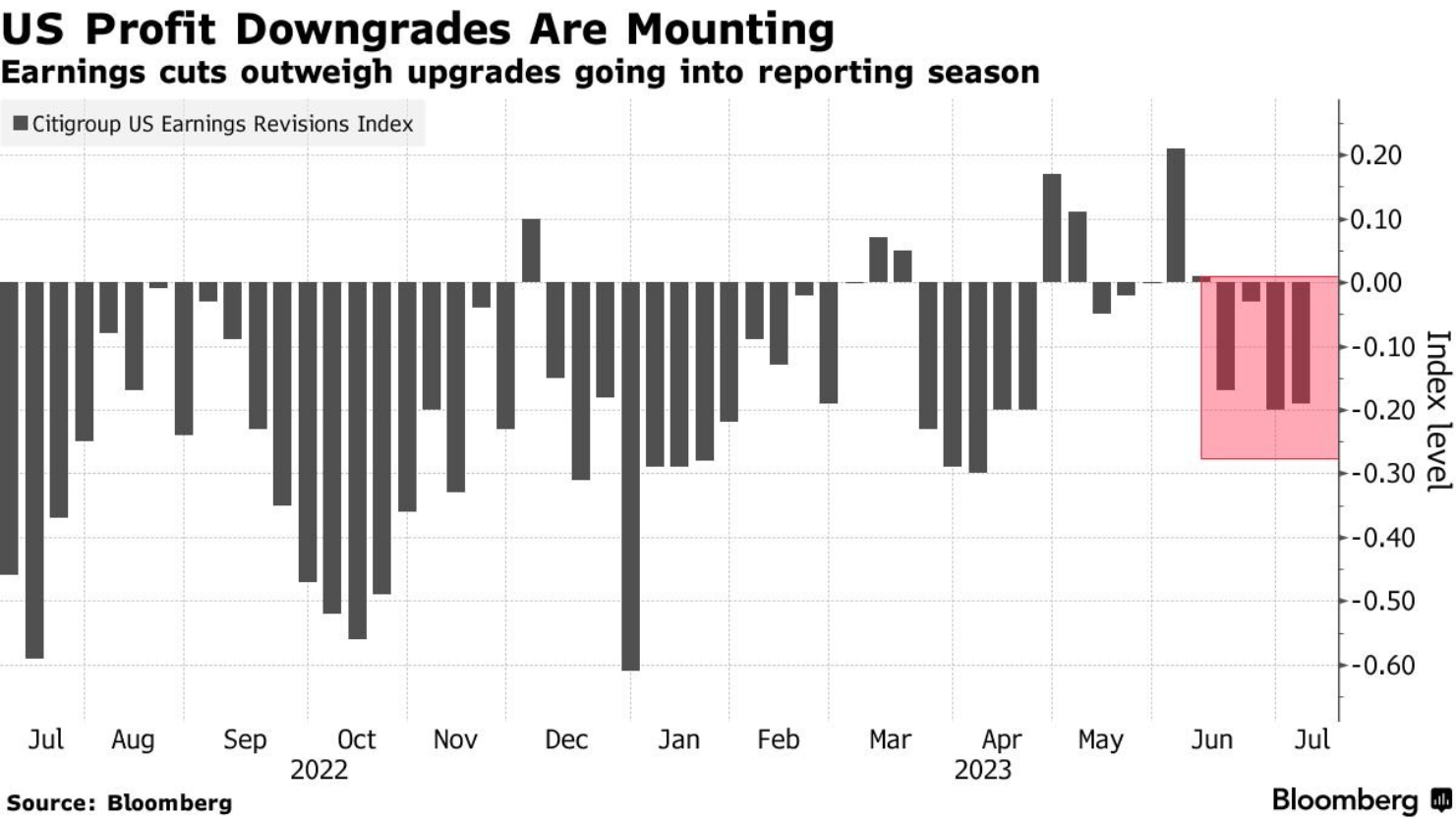

For example, bull markets take shape as Wall Street analysts raise their expectations on companies' profits. Yet analysts these days continue to lower their profit expectations:

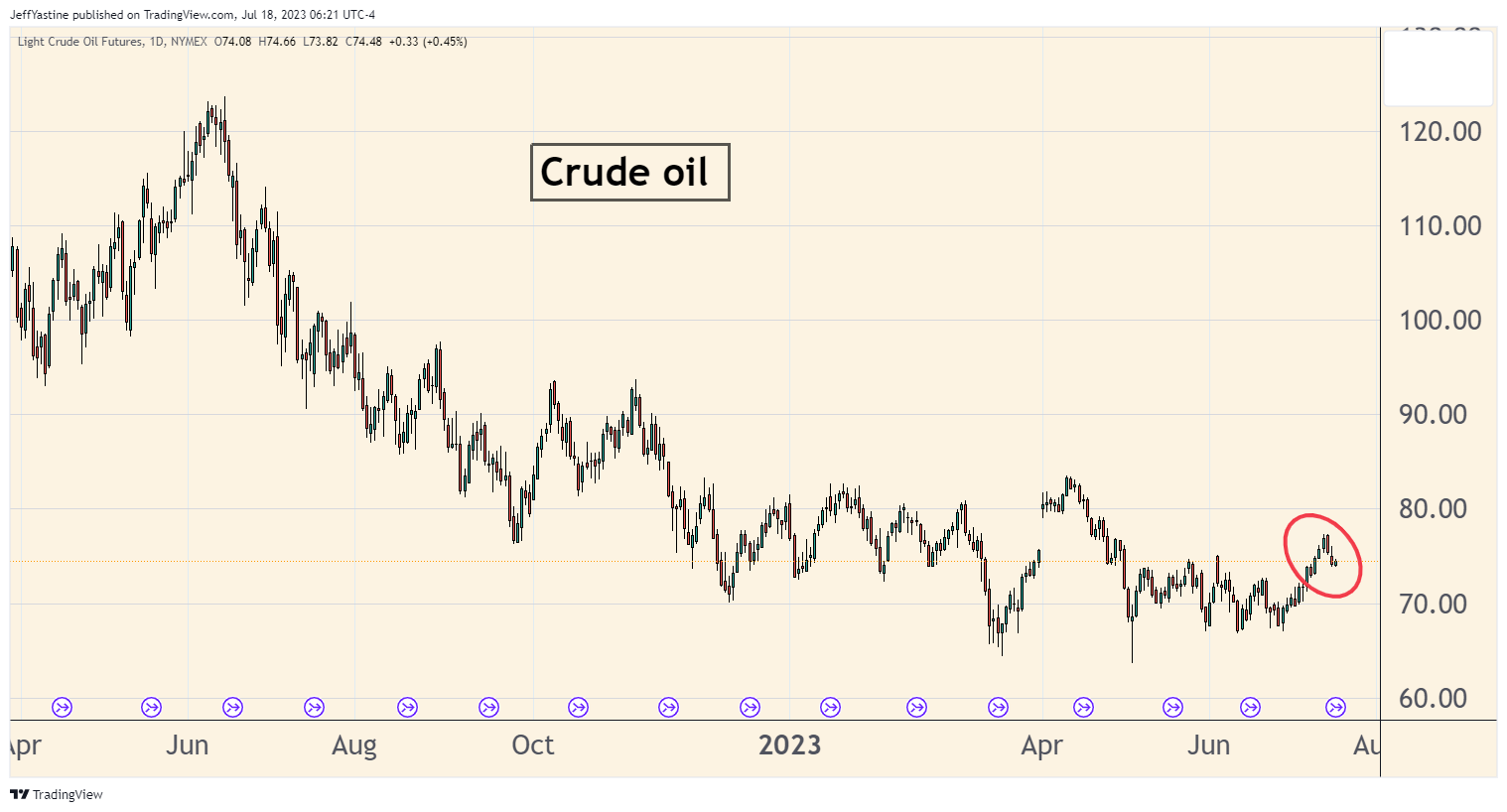

Oil prices remain stuck in low gear (mid-$70s a barrel) as well:

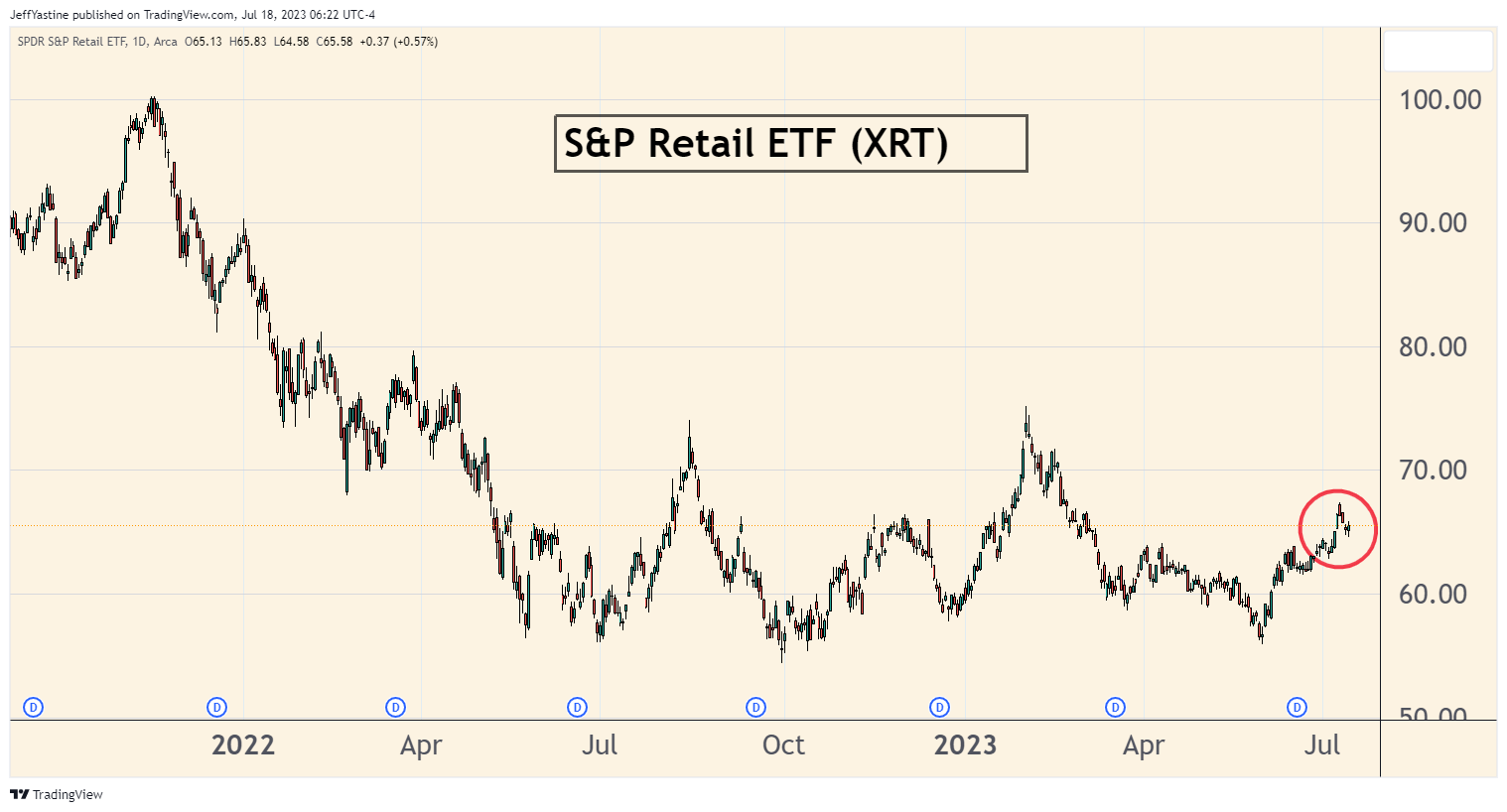

And no one is getting excited about the future of consumer spending, as measured by retailers' stocks these days, either:

So all this is just to say that it's "steady as she goes" for now.

Despite my suspicions, I continue to expect the indexes to plow higher through mid-August and probably the Labor Day holiday.

Between now and then, I expect we'll see news headlines soon about the Nasdaq 100 hitting "new alltime highs" - which ought to cause plenty more bearish investors to finally throw in the towel.

As I've been saying since mid-April, only when that process is complete will we see if the "new bull market" really has legs.

Or perhaps it's the horns we should watch out for instead.

Best of goodBUYs,

Jeff Yastine

Member discussion