Market Update: Look at What Happened Friday!

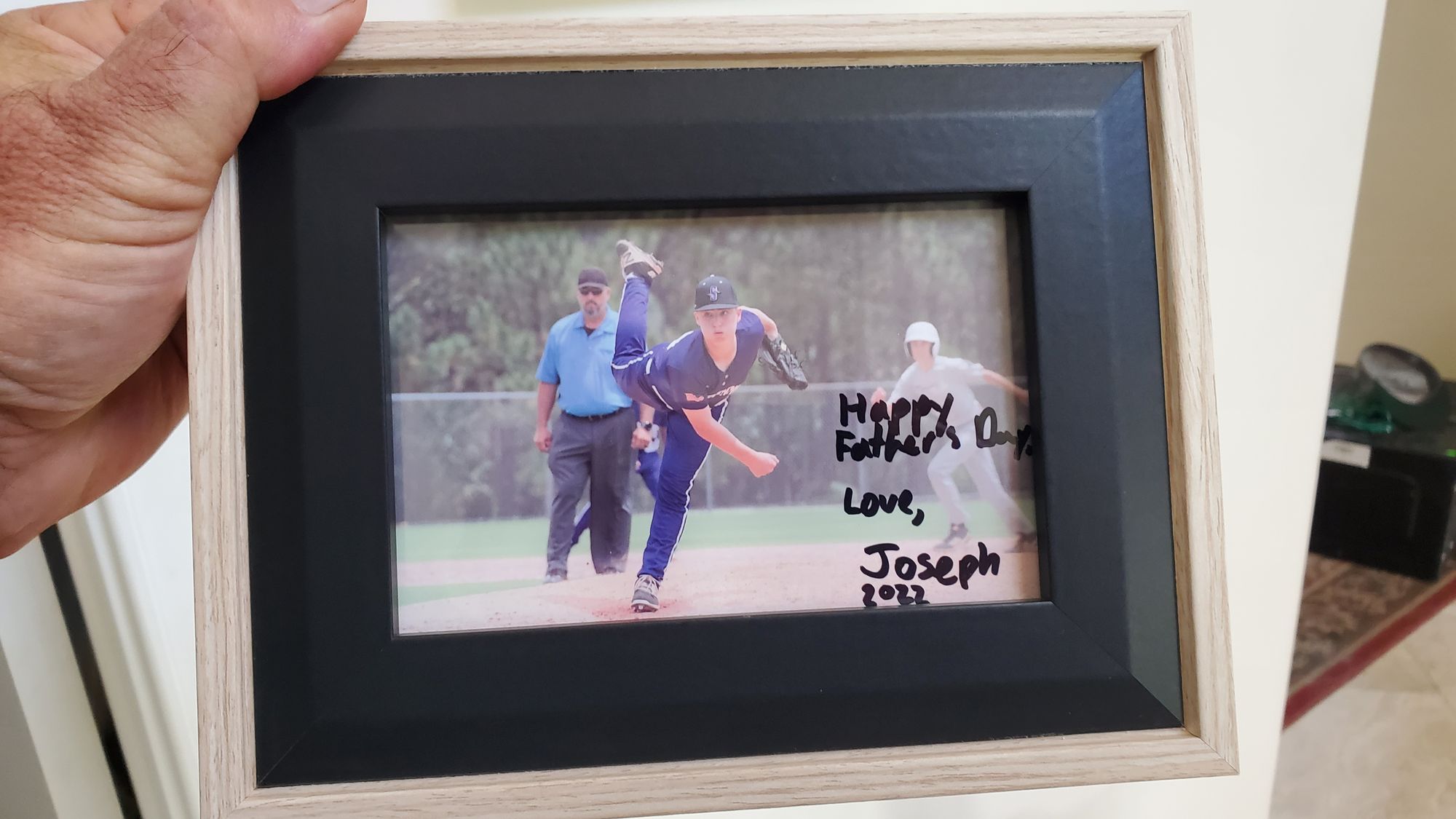

Happy Father's Day! My son gave me a nice framed photo of himself pitching at a recent baseball tournament as a Father's Day gift, which I will always treasure:

So on to the stock market...

Note to the Fed's Jay Powell: It looks like your rate hikes finally have the attention of stock traders, crypto traders...

And (if we care about a second-half stock market rebound)...oil traders.

The men and women who trade futures contracts in the oil patch have been resolutely bullish for many months now.

But on Friday, things finally started to crack as oil prices fell more than 6% to $107.99 a barrel:

That's important. The oil market is saying "enough" on the Federal Reserve's rate hikes, and anticipating a downshift in economic activity - something the rest of us have been experiencing to one degree or another since early this year.

So what does it all mean for the stock market?

The pieces are falling into place (in my opinion) for a strong rally as soon as we close out the month of June and the second quarter of the year.

Remember that everyone is thinking "inflation, inflation, inflation" at this point. The idea that inflation might be ready to moderate in coming months has yet to be considered by 99.9% of all investors.

As a financial journalist, I've seen these kinds of setups more times than I care to remember.

Wall Street strategists are out there talking about all kinds of rate hikes still to come by the Fed. But they don't really know. Ultimately, they reserve the right to change their minds and say "Gee, maybe the Fed won't raise as much as we thought."

By that time, the stock market could be 10-15% higher.

But we're talking the second half of the summer and early fall before those realizations begin to seep in.

So between now and the end of this month...I think we'll continue to see more weakness in much of the market as late-to-the-game investors keep selling based on the themes of the moment - inflation, and higher interest rates.

I expect the S&P 500 to keep falling. It's only a mere 7% decline away from hitting a major support level around 3,400 between now and then:

A lot of major retailers' stocks could lead the way. Most still have another "shoe to drop."

Stocks like Target (TGT), Walmart (WMT), CVS Health (CVS) and others finished Friday's session at the lows of the year - and it looks like they could fall very fast in the next 2 weeks:

A stock like Target could fall as much as 30-40% - and serve as a further warning to unwary investors.

I hate to put it this way...but that's how bear markets end - when the pain gets to be too much and the last stalwart bullish investors finally throw in the towel.

The point I'm trying to make is...it's almost over.

When the next rally gets going, it's going to take many people by surprise amid much doubt and skepticism.

Jeff

Member discussion