Preparing for a Bad Market While Times are Good

As investors - and human beings - we're sort of hard-wired to expect the routine. Whatever we've grown used to - good, bad, pain or pleasure - we tend to expect more of the same in the future. Experts call this human quirk "recency bias."

Unhooking ourselves from that expectation...well, that's one of the biggest challenges any investor or trader can face.

I think we can expect the current rally to continue for another 6 to 8 weeks. But whenever the Nasdaq 100 happens to score new all-time highs...that's when we'll know the clock is ticking on the rally, if I'm right about things.

And that's when we'll need to adjust our sense of routine, and the no-worries, effortless rally we've enjoyed for the past 3 months and counting.

The best example of the change in mindset required is the before-and-after of a hurricane or tornado.

For me, it was Hurricane Katrina rolling through Biloxi, Mississippi.

I'm not from Biloxi. But I knew the town fairly well - my first job in news was at a TV station about 2-1/2 hours away, and I used to drive down to Biloxi often, on weekends. In the late 1980s when I was spending time there, the town had an easy, relaxed vibe. Casino gaming - the big industry in the region now - wasn't even on the horizon yet, so it was all shrimp boats, beer, and soft summer nights.

Anyway, as a financial journalist in late 2005 I drove into town with my photographer for a post-Katrina business-news story.

Driving around, even at that point months after the storm - I couldn't get my bearings.

For an hour or so, I couldn't wrap my head around it. We'd drive past a street corner, and I'd remember a little bar or restaurant that used to be there - and I kept wanting to "see" that bar, even though there was nothing left.

So keep that little story in mind as preparation over the next few months.

We have plenty of time to enjoy the current stock market rally. But my instincts still tell me that once the Nasdaq makes new all-time highs - which I believe will happen by late August or after we get past the Labor Day holiday (Sept. 2-4), we'll need to be on alert for a change in expectations.

If I'm right, then the change from what we've gotten used to in recent months - the routine of tech stocks effortlessly coasting higher - may be hard for many investors and traders to wrap their heads around.

Week Ahead: More MegaCap Earnings

One reason why I think we'll keep seeing the Nasdaq plowing higher...

Apple (AAPL) and Amazon (AMZN) both report quarterly earnings this Thursday, August 3rd.

We're in an environment where it really doesn't matter what the companies say about their earnings or future outlooks. I think traders and mutual fund managers will buy anyway.

Another reason...Nvidia (NVDA) reports its quarterly numbers about 3 weeks from now, on August 23rd. Basically, this Nasdaq rally isn't going to fold until after Nvidia's soaring stock has finally run its course - and as you can see from the chart below, it's still working its way higher:

Long story short, I think NVDA could wind up hitting $600 before the rally is through.

Reasons to be Concerned

So I think we can continue to expect the stock market to work its way higher until the Nasdaq 100 (the QQQ ETF) hits new all-time highs. But beyond that...the signs are all around us that the rally is living on borrowed time.

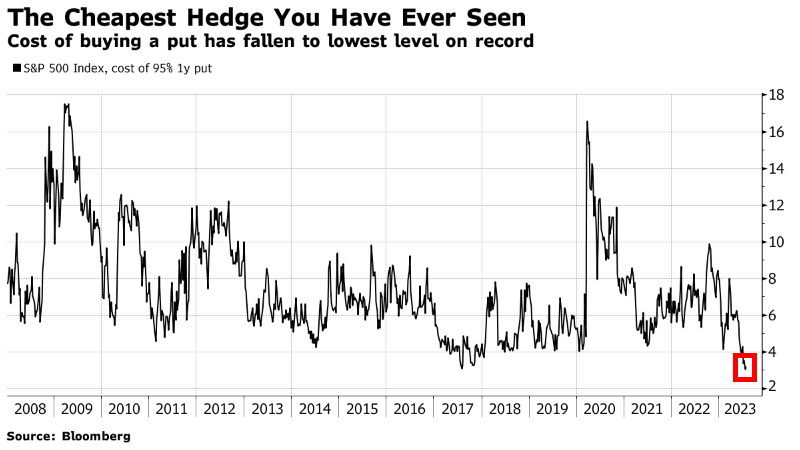

For example, I thought this chart below, from Bloomberg, was fascinating.

Basically, the chart is telling us that there's so little expectation of a stock market plunge right now that the cost of hedging against such a development - by buying an option "put" that goes up in price as the stock market down - has dropped to a record low price.

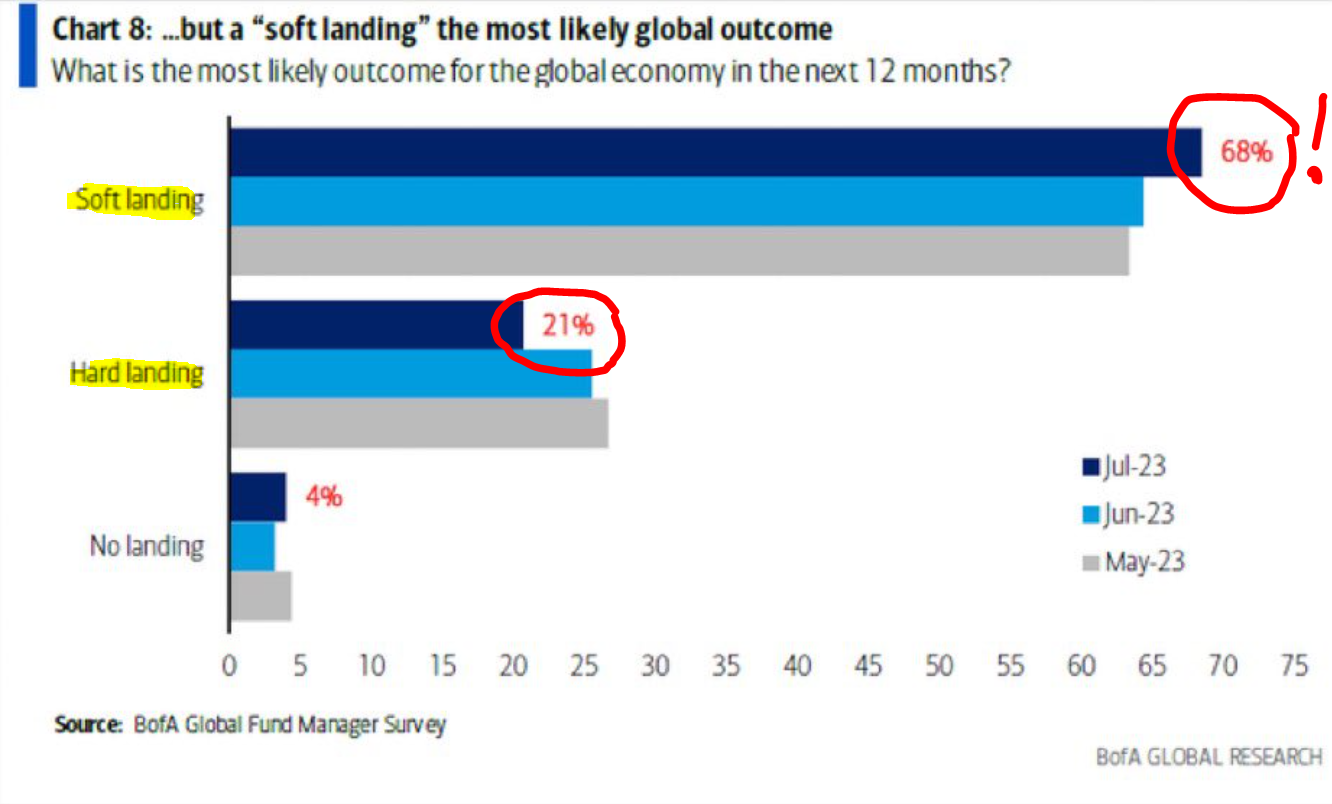

And clearly most economists have bought wholeheartedly into the idea that an economic soft landing is the only outcome worth considering these days:

And lastly, "bullish sentiment" - as measured by various survey groups like the American Association of Individual Investors (AAII) - last week hit its 8th consecutive week of "above average optimism."

By itself, that's not necessarily alarming. But if we think of the current rally continuing through Labor Day and perhaps beyond - and the bullish sentiment likely to prevail by that point - that's when we get into truly dangerous territory.

Closing out this week's post, I'll remind you of what I wrote on July 12 about "the mother of all melt-ups" being ahead of us. Back then, nearly everyone was extremely bearish - and I wrote:

When so many people bet heavily bearish on the market, the opposite often tends to occur instead.

Weeks later, we're rapidly approaching the other end of that spectrum of opinion, where everyone is getting heavily bullish.

That's the point where bad things tend to happen to the stock market.

Best of goodBUYs,

Jeff Yastine

Member discussion