Chart of the Week: Interest Rates...Threat to the Stock Market?

Before anything - have a great Thanksgiving tomorrow.

Treasure your time with family and friends. If things get stressful, learn to forgive in the moment. Let's remember the art of agreeing to disagree.

When I started off to college in 1982, interest rates were 16%.

Even though I'm really more of an "all-cash" type who hates going into debt, basically for my entire adult life, the cost to borrow - for mortgages, credit cards, cars, loans of any kind - has done nothing but get cheaper and cheaper by the decade.

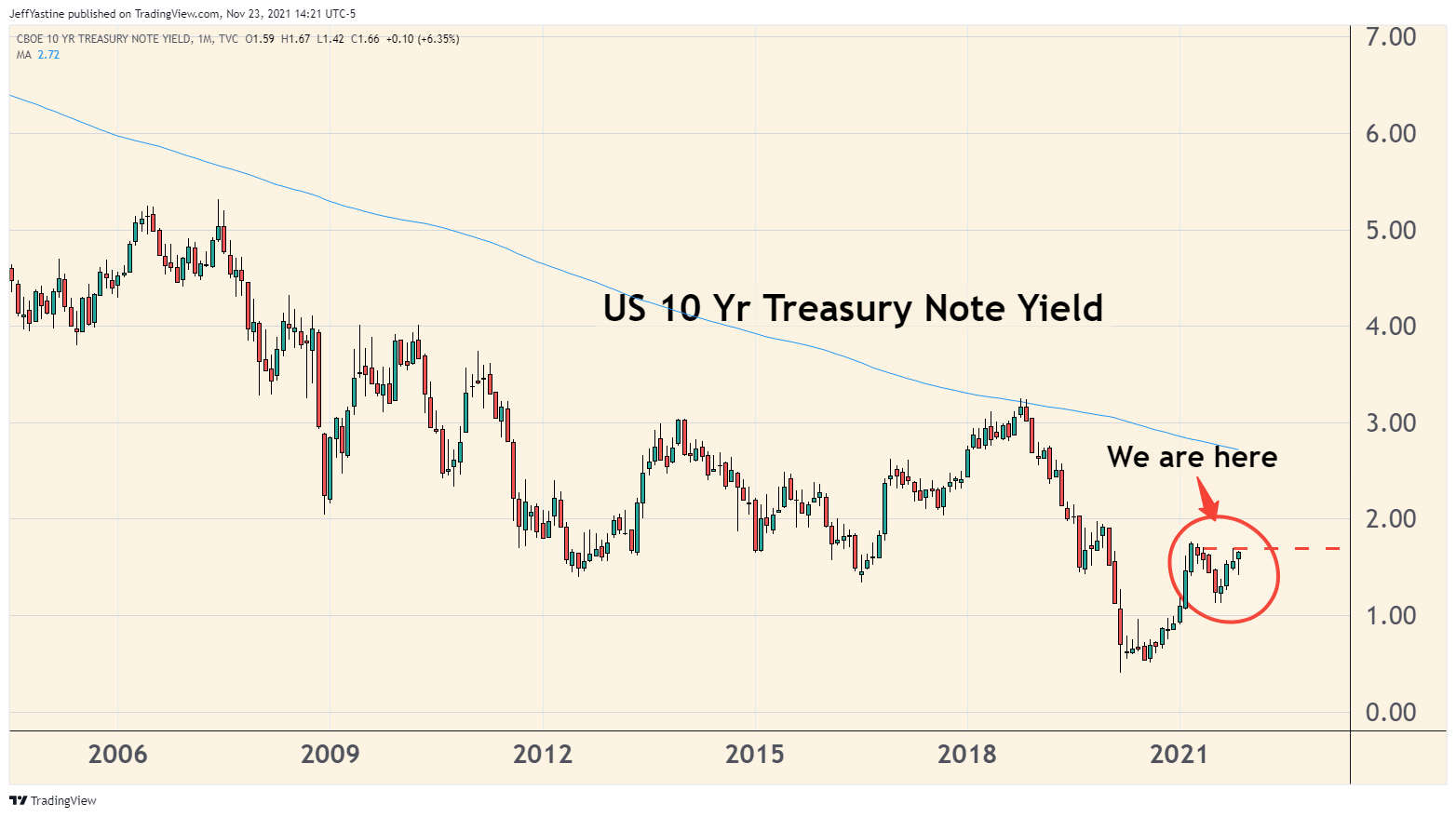

So a chart that plots the yield - the interest rate paid to the owner - for the benchmark US Treasury 10-Year Note, looks mighty interesting these days because it's threatening to go in the opposite direction.

If the 10-Year's yield hits the dotted red line around 1.75% - and keeps rising - it would be the first time in recent years that rates have meaningfully moved higher, rather than stair-stepping lower and lower.

Is it necessarily a big deal? We can all comfort ourselves by saying "the Federal Reserve won't let rates go up all that much." So we won't know the real impact except by looking in the rear-view mirror.

Inflation is on the rise. But presuming the global economy continues to crank back up to speed (either slower or faster, depending perhaps on the severity of winter COVID outbreaks), headline-grabbing price increases could indeed be "transitory."

And as you can tell from the long-term chart below, the 10-Year's yield - even if it eventually rose to 2% or 3% - is still at historical lows:

But it we take a step back, it looks to me like the bond market may be starting its long-awaited adjustment to the Federal Reserve's recently announced policy of "tapering" its bond purchases.

In other words, the central bank - which stepped in to support the bond market in the darkest days of the pandemic - said it would no longer buying as many mortgage bonds and other interest-rate securities, which provide additional liquidity for the bond market.

In the bond market, the math works like this: When the market price of a bond goes up, the interest rate that accrues to the buyer of the bond...goes down.

So without the Fed to serve as a "buyer of last resort" and keep bond prices higher...what happens?

There's less buying interest, and things move into reverse - the price of bonds goes down, and the interest rates paid on those bonds goes up.

In Powell's view, the markets should be able to stand up on their own and endure the aches and pains of rising interest rates - which make it that much harder for businesses and consumers to borrow.

That's also why the chairman and others at the Fed continue to state that they should plan to start raising interest rates in earnest in another 18 months or so.

But the key is whether the stock market, as represented by a heavily-indebted corporate America (as well as we the American consumer) can withstand having to pay a bit more on our loans as rates creep higher.

Impact on Stocks?

One thing to keep in mind...

The markets like to "test" the Fed sometimes.

I can remember late 2018, when the S&P 500 fell nearly 20% from October through the end of the year. The fear then was that the Federal Reserve was being "too tight" as it began to gradually raise interest rates.

So the market fell and fell. It was a test of Powell's resolve. Ultimately, he was forced to walk back any notion of further rate hikes, and the market went back to rising again in 2019. A year later, the pandemic came along and made the whole notion of "higher rates" a moot point.

As we watch the Nasdaq begin to sell off in recent days, the question is back again with a vengeance.

If the Fed keeps up its course, it won't be the end of world (though it could mean a stiff potential correction in 2022). But it could mean a new set of winners and losers for the stock market's next bull market cycle.

Best of goodBUYs,

Jeff Yastine

Member discussion