Market Update: Is the "Mother of All Meltups" Upon Us?

Skip to the bottom if you want to read only about the "mother of all meltups."

"Meltups" - like "meltdowns" - have an air of inevitability about them. Like, they just have to happen, no matter what else.

With that in mind, last week saw some exciting market action, but for reasons that are less obvious to most people.

But cutting to the chase on these things, I think the stock market can keep methodically working its way higher in a way that makes it deceptively easy to get excited about the markets once again.

Lots of "New Bulls"!

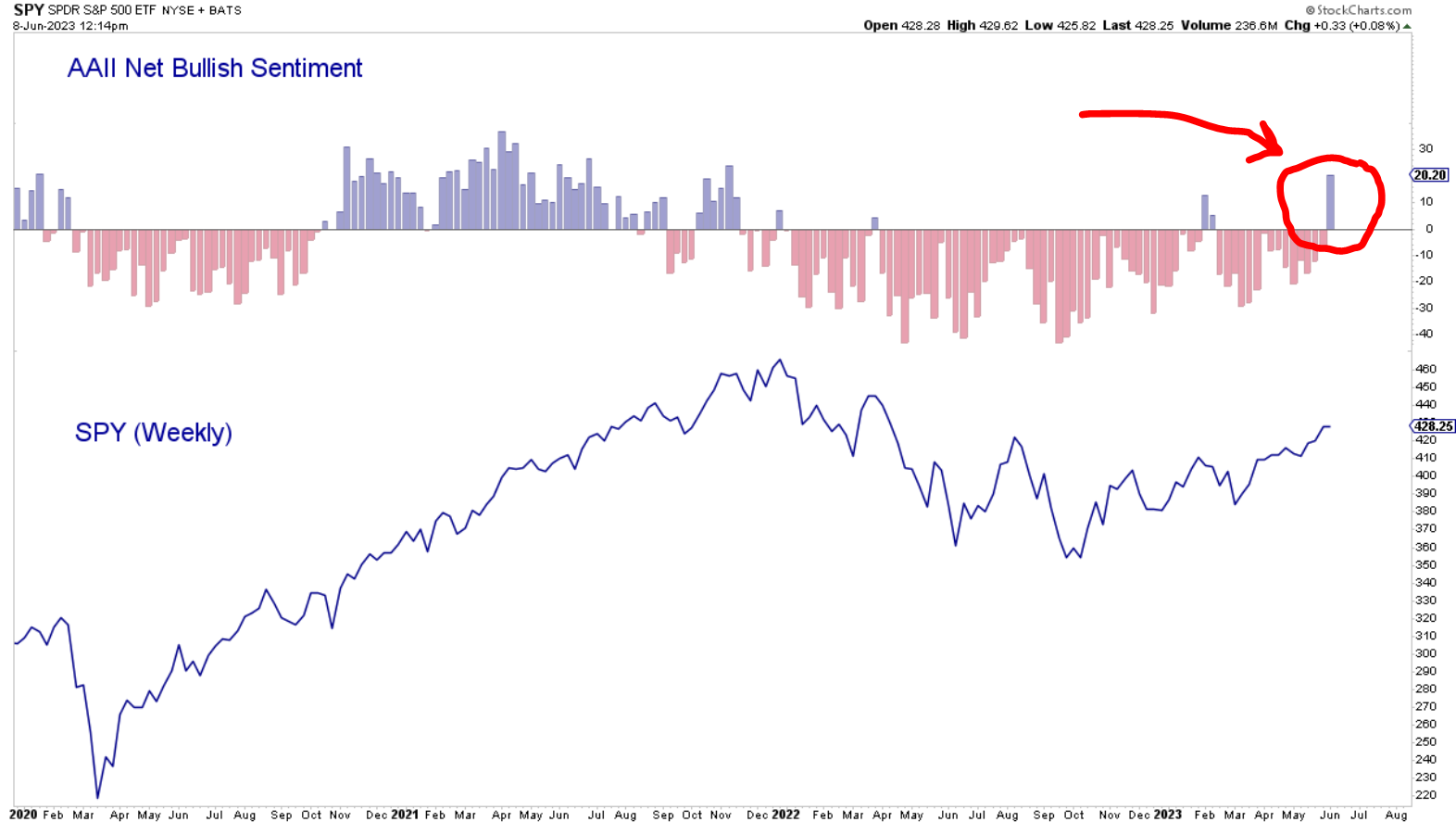

For instance, for most of the past 6-8 weeks, I've been saying that the stock market had to move higher. There were too many "bears" - too many people betting against the stock market. Back on May 30th, I noted the record amount of short-selling activity (the highest in 12 years)...

When so many people bet heavily bearish on the market, the opposite often tends to occur instead.

Last week, for the first time, it looks like the inexhaustible rise of the Nasdaq since then has finally cured many traders and investors of their bearish opinions:

And if we want to gauge the opinions of the folks who help set our opinions - by writing the financial headlines and news stories...they're feeling pretty optimistic now as well.

Here's the front page of Barron's weekly magazine this weekend:

If you're new to the stock market, it helps to pay attention to what headline writers say. They're a perfect "weathervane" for the opinions of ordinary investors. When financial news editors become resolutely bullish, it shows the "conversion process" from doubter to enthusiastic investor is more or less complete.

Lastly, if we look at the riskiest part of the stock market - small-cap stocks, as represented by the Russell 2000 - those stocks rose about 3 percent last week, best among all the major indexes:

So what gives, and how much higher can this thing go?

My opinion - I continue to believe we should sit back and enjoy this rally. I think it will continue to move higher at least through the July 4 holiday, and likely into late August/early September. My attitude is to invest and trade, and identify opportunities - but make a point of not getting too excited about things.

If it's the real deal, it should continue to rally, then selloff, then rally again. That's typical bull market action, of the kind that slowly broadens to include more small-company stocks and other out-of-favor companies.

But my continued suspicion is that the current rally is ultimately a trap to be sprung later this fall.

Fed Meeting This Week

One reason I think we're looking at a trap (later, down the road)...has to do with this week's Fed meeting on interest rates.

The puzzle is that many investors - looking at data that points to receding inflation expectations - expect the Fed to soon "pause" on its aggressive moves to hike interest rates.

I'm not so sure.

To me, the higher the stock market goes - the more permission it gives to the Federal Reserve to keep hiking interest rates.

I mean, interest rates have gone from nearly zero to almost 4% - the highest level in a decade. And yet the S&P 500 is only down about 9% from its all-time highs and 20% above its lows from last fall?

It's worth noting that the central banks of Canada and Australia both hiked their interest rate targets last week.

If I were Jay Powell, I would be looking at the current market rally as a perfect opportunity to keep raising interest rates.

That way, if the economy is in the early stages of a recovery, I can keep inflation from getting out of hand. But if it turns out we're going to see an economic recession instead - the higher I hike rates now, the more "wiggle room" I have to start cutting them later in an attempt to revive economic growth.

"Mother of All Meltups" Ahead?

The long and short of all this is that the market (in my opinion) will continue to pound its way higher until everyone is firmly convinced that the 2021-2022 bear market is extinct.

In similar fashion, famed market strategist Ed Yardeni made headlines last week by noting that he expects the stock market to have "the mother of all meltups" in coming months in the "FAANG"-type megacap stocks - followed by a return to a bear market:

We'll explore the idea of a "meltup now, meltdown later" in coming posts.

But for now, enjoy the rally for its summer entertainment and money-making potential.

Member discussion