Selling This Position for 100% Gains + New Buys & Sells

Hi everyone. I'll keep this short...

I think we have seen the top of this particular move in the stock market.

As I've noted in previous posts, it's uncanny the way the market today is mirroring what the DJIA did in March 2002 - just prior to a very sharp 6 month decline.

My bet is that the first phase of that renewed decline is starting now:

There's more to it than that, of course. The key is that both the Nasdaq QQQ's these days, and the DJIA in 2002, were the only indexes to make new "higher highs." To me, the fact that the other indexes did not indicates the dangerous quicksand under the market's surface.

With that in mind, I think now is a good time to add a few additional short-sale positions to the goodBUYs portfolio, and take profits on a few long positions as well.

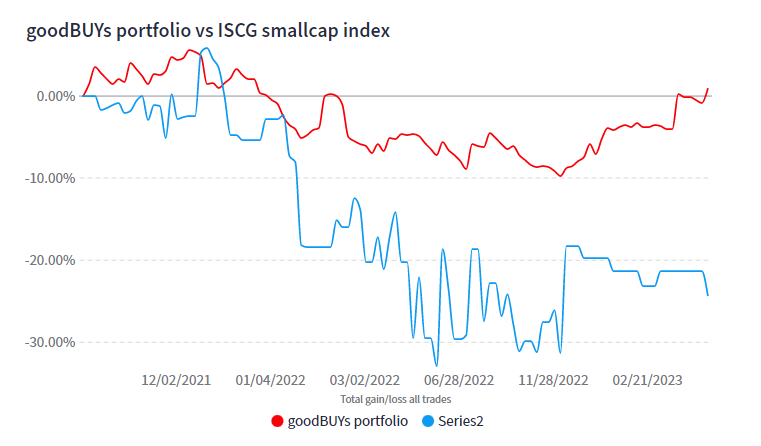

First, here's what the portfolio looks like right now - just above breakeven:

Like I've said many times before, my goal in a bear market isn't so much to make a lot of money - it's to avoid losing a lot of it. I think we've achieved that goal thus far.

2 New Sells:

- Selling 50% of AVITA Medical (RCEL): The portfolio has a 102% gain in this position. I'm going to take profits on another 50% of the remaining shares. You'll remember I cashed in a chunk of the original initial position for an 89% gain back in early March.

- Selling 50% of Everspin Technologies (MRAM): The portfolio has a fractional 2% gain in this position. I'm going to take profits on half.

I believe MRAM and RCEL could be stocks that help lead the next bull market higher, so my anticipation is that perhaps I can rebuild bigger positions at lower prices - if I'm correct about renewed selling pressures in coming months for the broader market.