Weekly Market Update: "Don't Be the Crab"

NOTE: Premium subscribers, your full portfolio update follows below. Also, come Monday I'll be recommending a brand-new stock for the goodBUYs portfolio that I think could triple in price over the coming year.

When it comes to stock market selloffs, like the (so far, mild) one we've seen of late - the image of a crab always comes to mind.

I can't help it. When I was a kid, we moved from the NYC "suburbs" of northern New Jersey to the swampy coast of southwest Florida, and a little town called Punta Gorda.

I loved it. Everyone had a boat. Most of our neighbors also had crab traps out on nearby Charlotte Harbor, each one with a plastic milk jug floating above to mark its spot.

Every once in a while, someone would give us a bucket or two of live blue crabs, much like the one in this stock photo:

I always remember a neighbor telling us the "drama free" way (for my mother, not for the unfortunate crabs) to prepare the meal...

Put them in a big pot with nice cool water, he said, and then turn on the heat.

"By the time the crabs realize they're in trouble, it's too late."

Maybe that's why I'm not a big crab eater, but that's another story.

The key point is that when it comes to the stock market - don't allow yourself to be complacent. Understand the potential risks and rewards of the goodBUYs in your portfolio.

But most of all... don't be the crab. Don't let your positions - and confidence - slowly get "cooked" (i.e. selling at a deep loss) to a point when it's too late to do much about it.

Value vs Growth

For example, I have lots of dividend stocks in my personal portfolio. Those are going up and doing well. I added a few others - mostly energy and health names - that caught up in even more selling into the end of last year; those stocks are doing really well too.

Meanwhile, most of my growth-type stocks I sold late last year. I'm carrying something like 50% cash or more in my family's portfolios. I've tried putting some of it to work on various growth-oriented goodBUY stocks in past weeks - but those kinds of positions have continued to weaken.

So I've taken small losses and exited those trade ideas; I'm being patient, biding my time, and waiting for better entry points in the future.

Truth be told, 95% of the time, stock market selloffs - however shallow or deep - are inconsequential. In practice, they represent opportunities for goodBUYs at lower prices.

But that's not how it feels when we go through one mentally unprepared for the experience, and for the potential risks in our stock positions (more on the risks part, below).

As of Friday, here's where the major indexes finished below their last previous all-time highs:

- Russell 2000: -11.5%

- Nasdaq Composite Index: -8%

- Nasdaq 100: -7%

- S&P 500: -3.2%

- DJIA: -2%

I'm wrong as often as I'm right on these things, but my guess is we have more downside to go. My market "spidey-sense" sees plenty of folks getting more aggressive and more bullish as the markets work lower - we want to see the opposite (people getting scared).

That's just not happening yet, in my opinion.

But the real news is going on underneath the surface of the market.

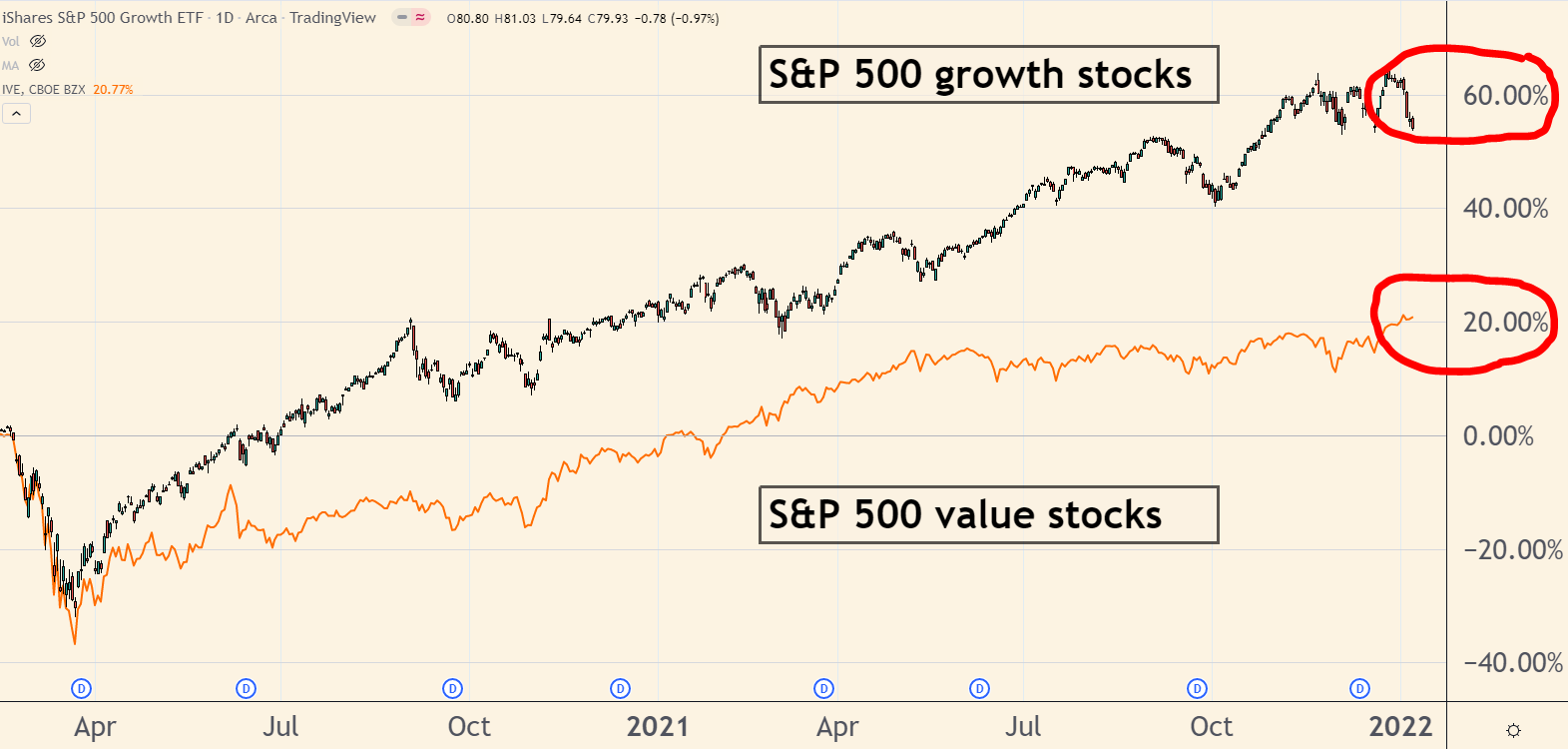

We can see the change if we break the S&P 500 into two halves, which the iShares folks have done with 2 exchange-traded funds, S&P 500 growth (IVE) and S&P 500 value (IVW).

If this were a perpetual horse race, growth stocks have been leaving their value competitors in a trail of dust for years.

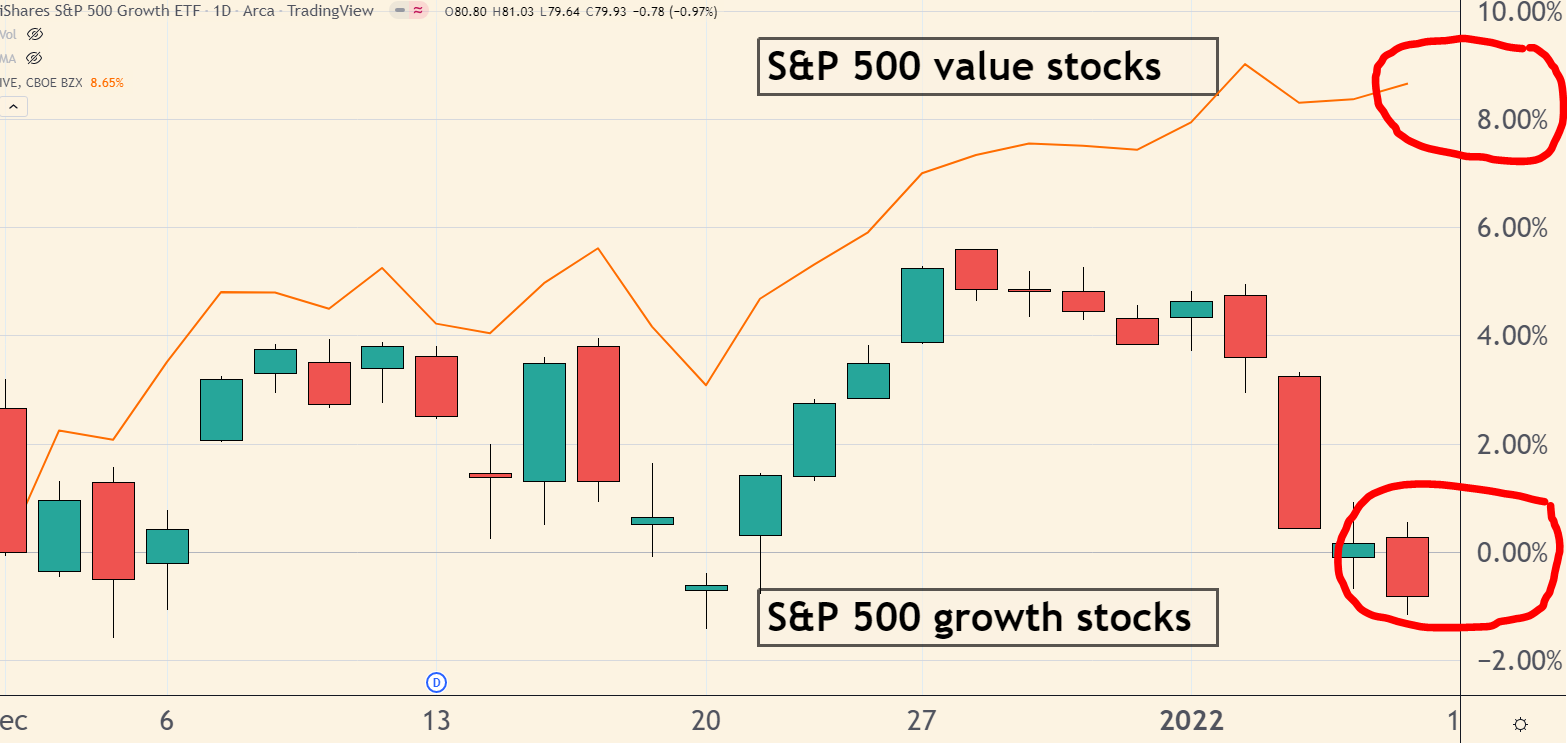

But since Thanksgiving, the S&P 500's value stocks suddenly woke up. Now they're outpacing the index's growth stocks by a wide margin:

The bigger question is whether this growth vs value "lead change" is the beginning of something more important and longer-lasting.

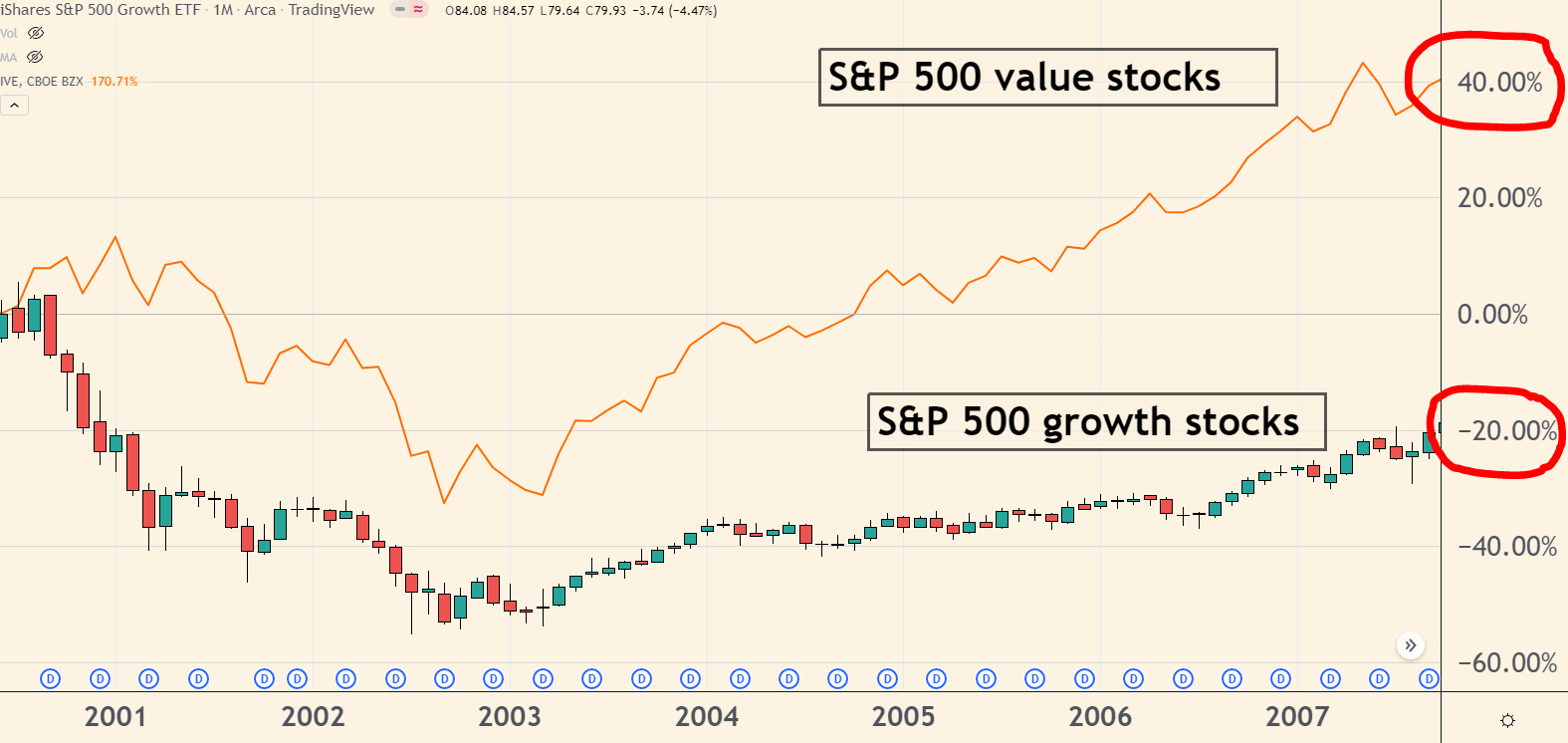

For instance, as you can see in the chart below, growth stocks lagged for a long 8 years - from the 2000 - 2003 bear market, and all the way through the next bull market before the 2008 housing bubble collapse.

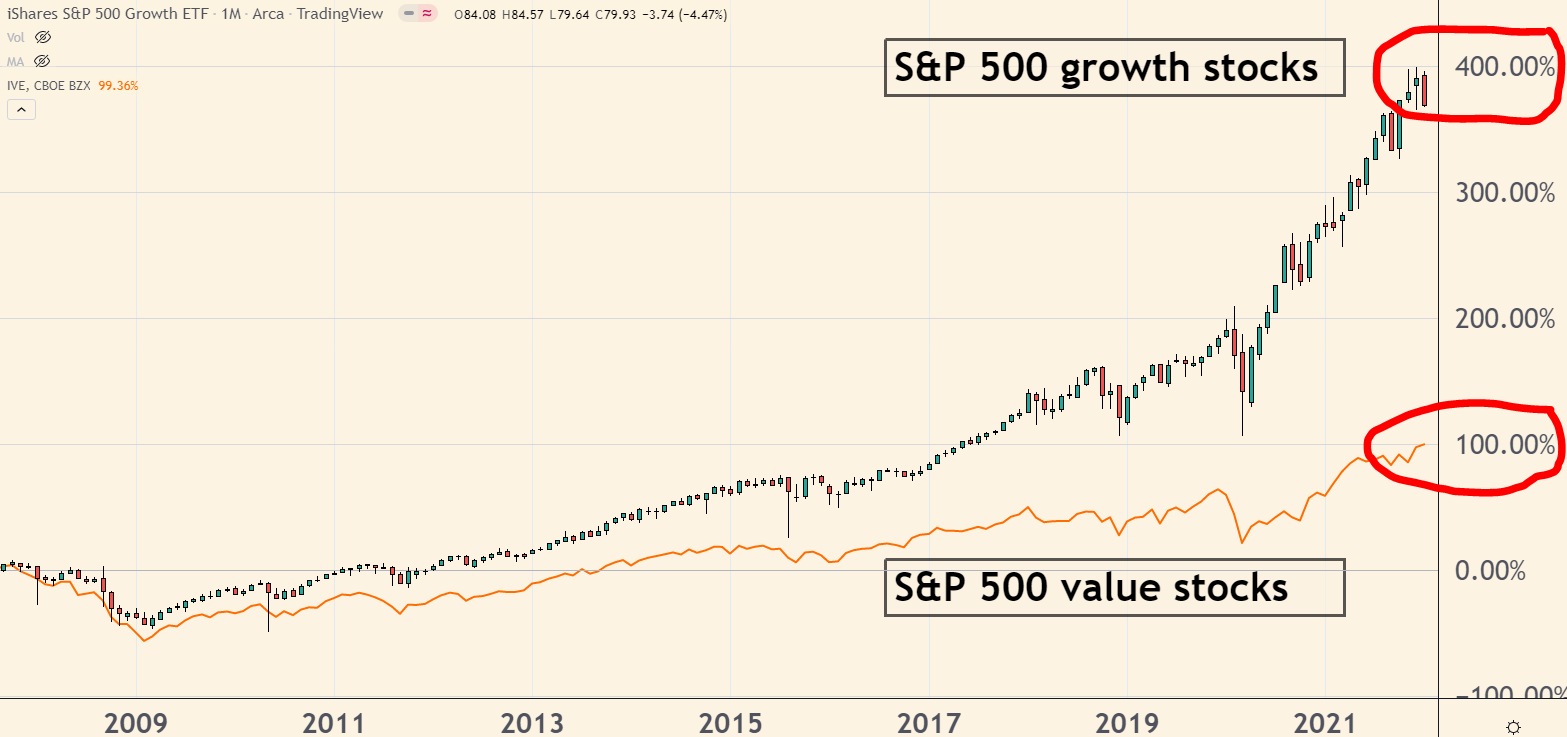

And as all of us know, after 2008, growth and value switched places yet again as the Fed kept interest rates ultra-low, and amid a steady persistent decline in oil prices rates (which peaked in 2008 at $140 a barrel) that made inflation nearly extinct:

So this is why I say there are additional risks (and I should point out, opportunities) in any correction or large market selloff. Big corrections can represent a potential long-term change in what stocks lead the market higher, and which ones are the laggards.

Portfolio Diversity

That's a key reason why I try to recommend a mix of new stocks in the goodBUYs portfolio for premium subscribers, because we never know how the "horse race" between growth and value works itself out.

So some of my portfolio positions are big, underpriced S&P 500-type value stocks that tend to do especially well at times like now. Others are undiscovered, promising companies that ideally hold their own in the downturns, and surge higher in the rallies - and could offer strong gains and market leadership in the years to come.

So try to keep your focus not so much on what's happening in one trading session, one week or one month. Keep in mind the bigger picture and try to choose a range of stocks that offer possibilities.

Some stock ideas will work out. Some will not. But over time, we don't need many big winners to create a portfolio with a really good long-term winning percentage.

Speaking of our goodBUYs portfolio, I'm anticipating continuing gains in the most unlikely of individual stocks in the coming week...airlines!