Weekly Update: What's Next for the Market, and Moderna?

I have my Moderna expectations in the subscribers-only "Portfolio Update" section below.

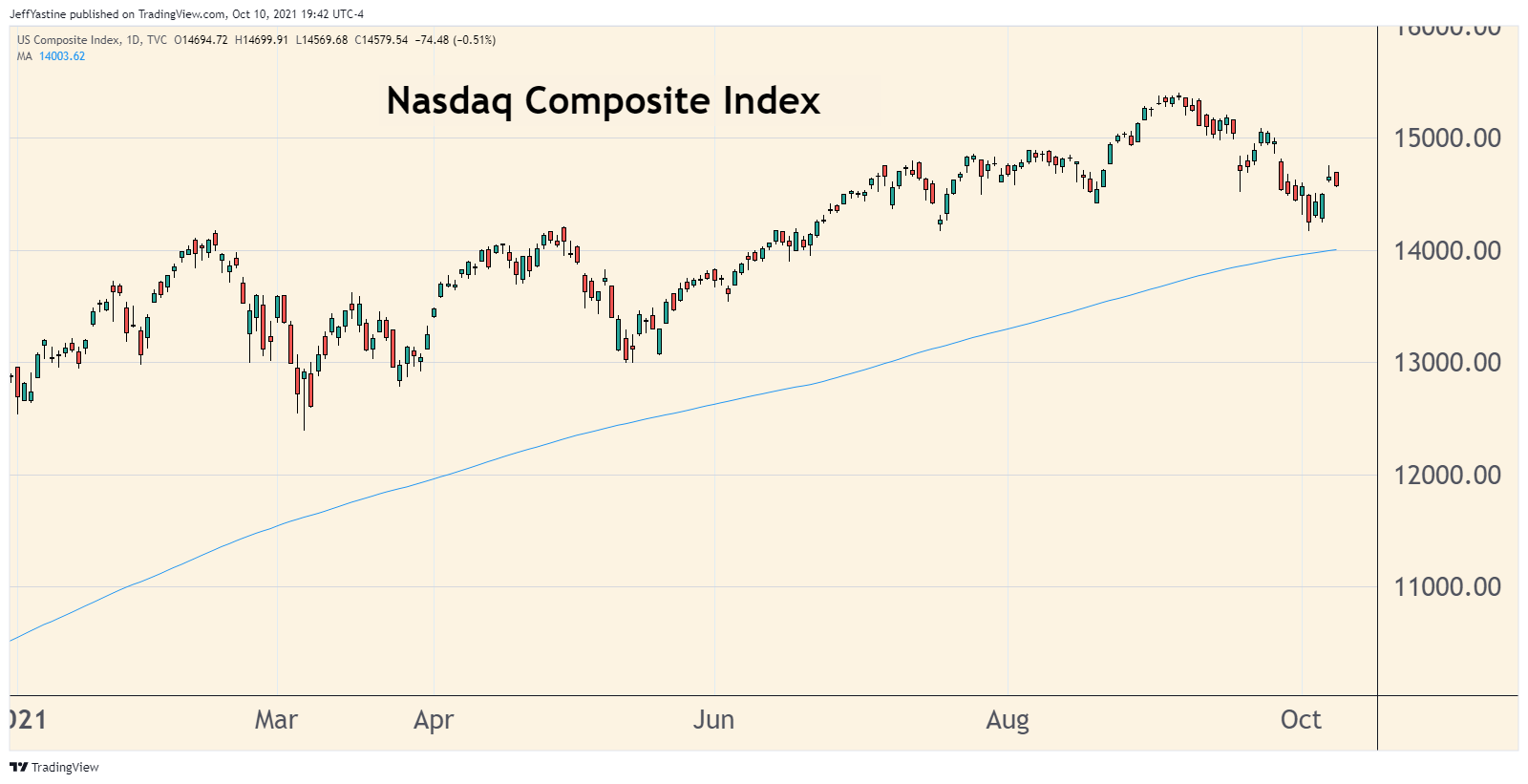

But as far as a market prediction... I think stocks are going to be pretty boring on the whole, for the next 4 weeks or so.

But in the process, I think the market will keep edging higher.

If I'm right, then it's possible we could see marginal new highs by the time we get to the first week of November.

After that, the market's boring phase should end pretty quickly (more on why, below).

We'll soon see at that point just how incredibly bullish...or sneakily bearish "Mr. Market" is going to be.

We could see a huge liftoff in the market. But it also wouldn't be the first time that Wall Street pulls out the rug when most investors least expect, and just when investors are looking forward to the seasonally-bullish final 2 months of the year.

More on that theme a little further below.

Earnings Season on Tap

One reason for expecting a general trend of higher stock prices in coming weeks is that Congress has kicked the can on the budget ceiling fight...a few more months down the road. Out of sight, out of mind for Wall Street.

Another reason for optimism (for the time being) - this coming week starts Wall Street's third quarter "earnings season." A blizzard of companies report their revenue and profits for the period.

I'm sure some will disappoint, or warn that inflation worries may hurt their bottom lines in coming quarters.

But somehow I doubt it will do anything to ruin the mood.

For example, Tesla (TSLA) reported good Q3 sales last week. But Elon Musk noted "significant cost pressure" because of supply chain issues. The company was actually flying its most-scarce parts on planes, and flying those parts to its assembly plants. Tesla even raised vehicle prices by $2,000 to pay for it all.

Analysts shrugged and raised their Q4 and 2022 profit estimates.

If Tesla can get a pass on this sort of thing, then I think it's likely that the key stocks in the rest of the big tech companies will get a pass as well.

Oil Prices Keep Rising

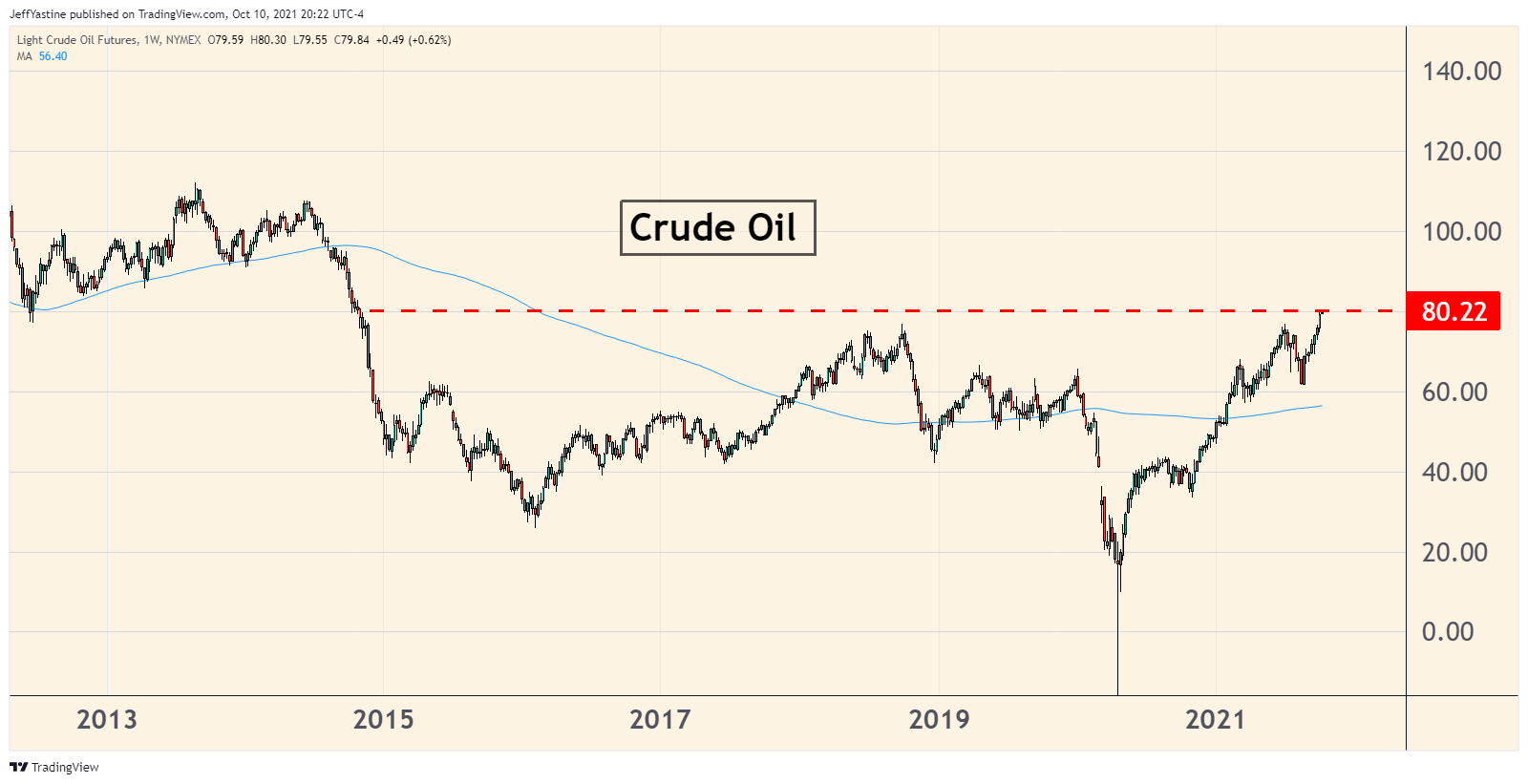

Our bet - that higher oil prices would propel a portfolio holding of ours higher - continues to pay off nicely.

Our gains are still modest - we're up about 16% on our positions in this stock. But old-school energy companies are one of the only sectors that's actually moving higher in the current market, and should continue to do so in coming weeks.

With an eye on the rising oil price trend, it's also possible to paint a positive picture on the global economy as it emerges from its Delta variant-induced coma of recent months.

But as I'll show you before, rising oil prices - while welcome right now - could hurt the bull market eventually.

Federal Reserve's November Meeting

And as the third quarter earnings season draws to a close, the spotlight shifts to the highly anticipated Federal Reserve meeting of the year.

OK, I don't get excited about upcoming Fed meetings. Sorry.

But the rest of Wall Street does.

The November 2-3 meeting is a big one, because expectations are high that the central bank will finally announce that it's going to "taper" its bond purchases (which inject massive amounts of liquidity into the economy).

In the next few weeks, we're going to see more and more headlines like this recent one from Reuters, building yet more anticipation for the big event.

So how do we pull all these loose threads together?

I think the key - what we need to pay attention to most - is going to be the trading action on the handful of days following the November Fed meeting.

There's a case to be made that the market is primed for a big rally as anticipation builds for a back-to-normal economy. No question about that. As far and high as this bull rally's come, it can go still higher.

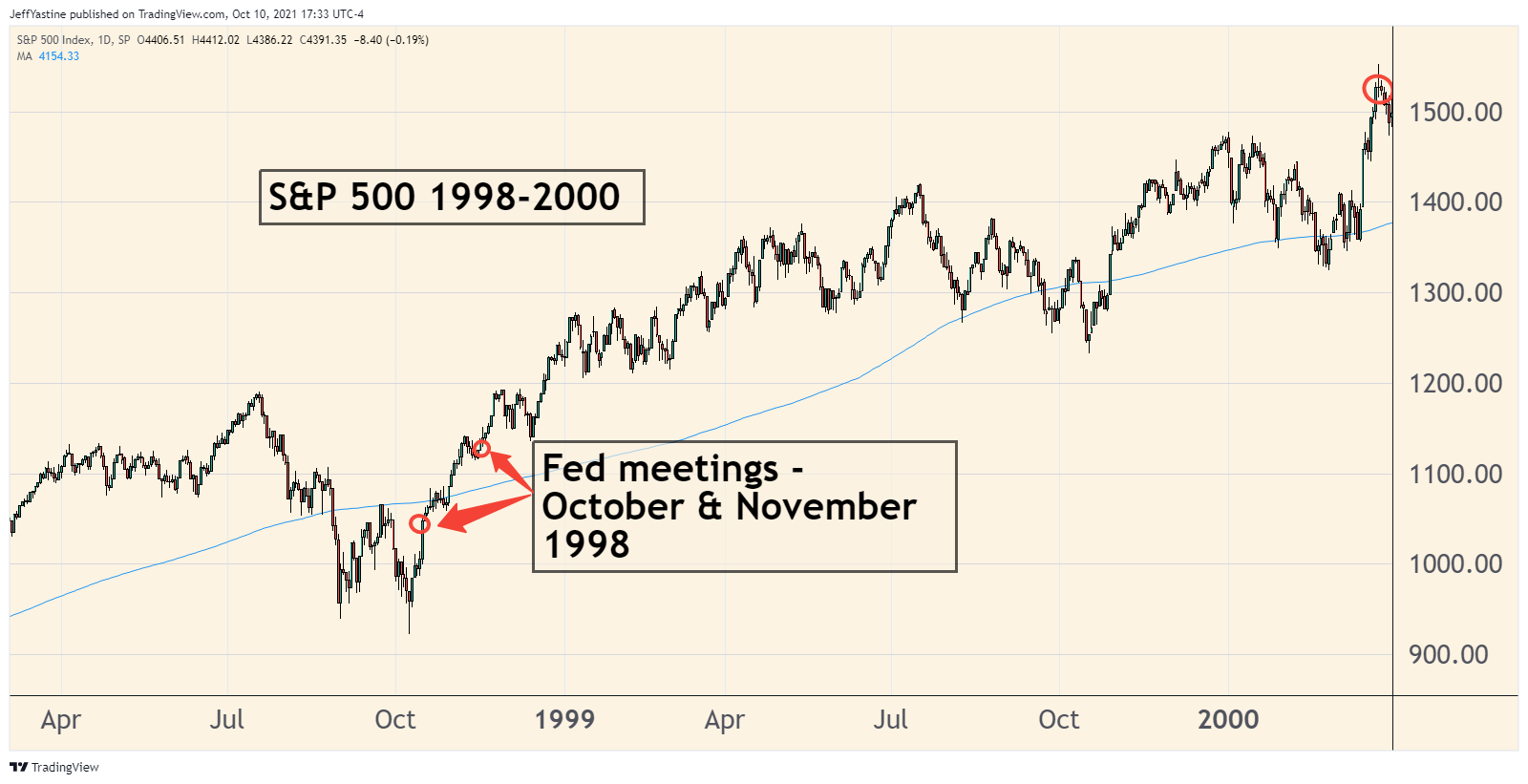

A good example is 1998.

The market sold off from its July highs that year by 20%. But once the 'uncertainty' of the October and November Fed meetings was out of the way, it was off to the races for the next 18 months.

That's what I'm hoping for this year. Plenty of folks on Wall Street and Main Street are expecting the same.

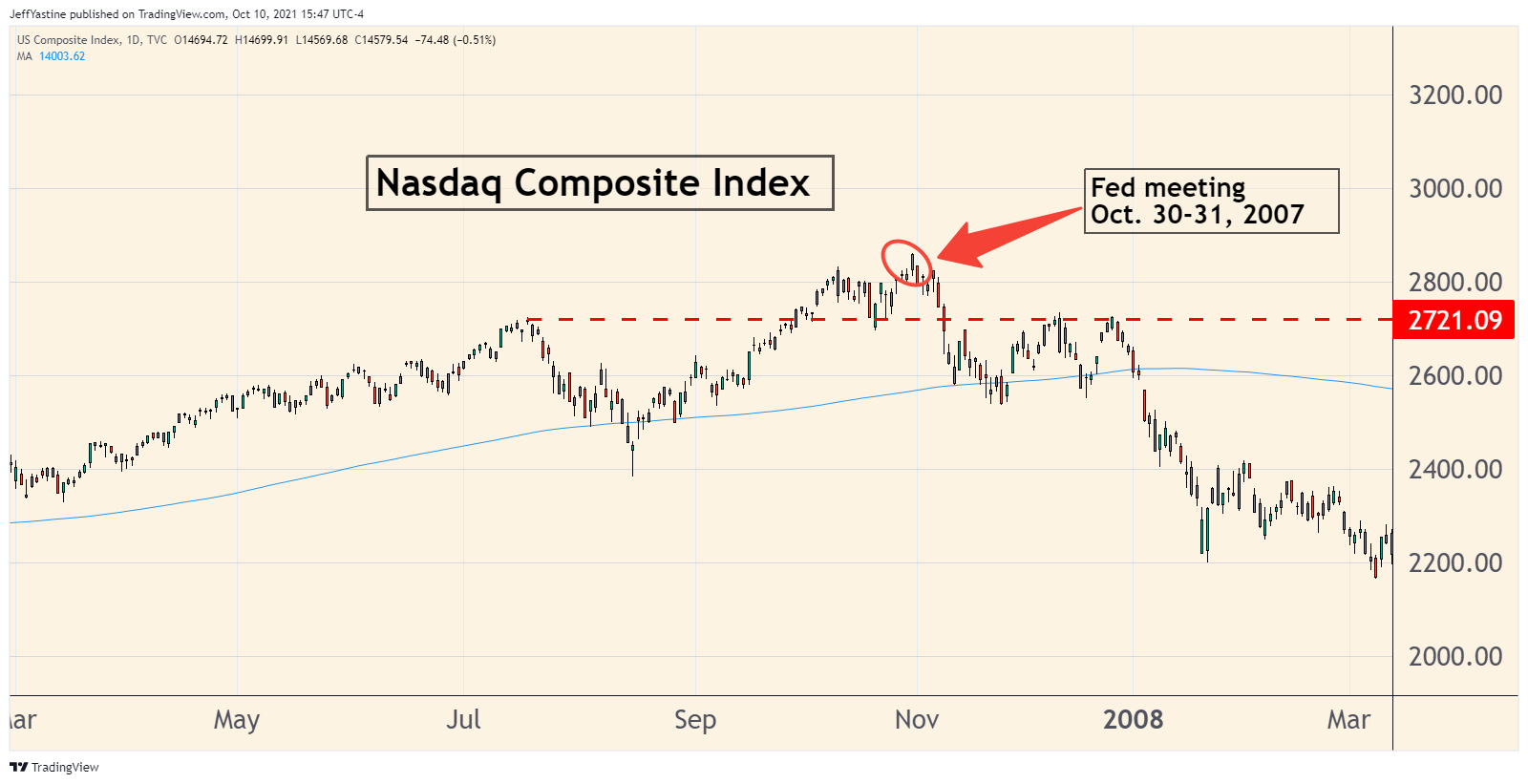

But sometimes Wall Street uses those "November = party time" expectations against us.

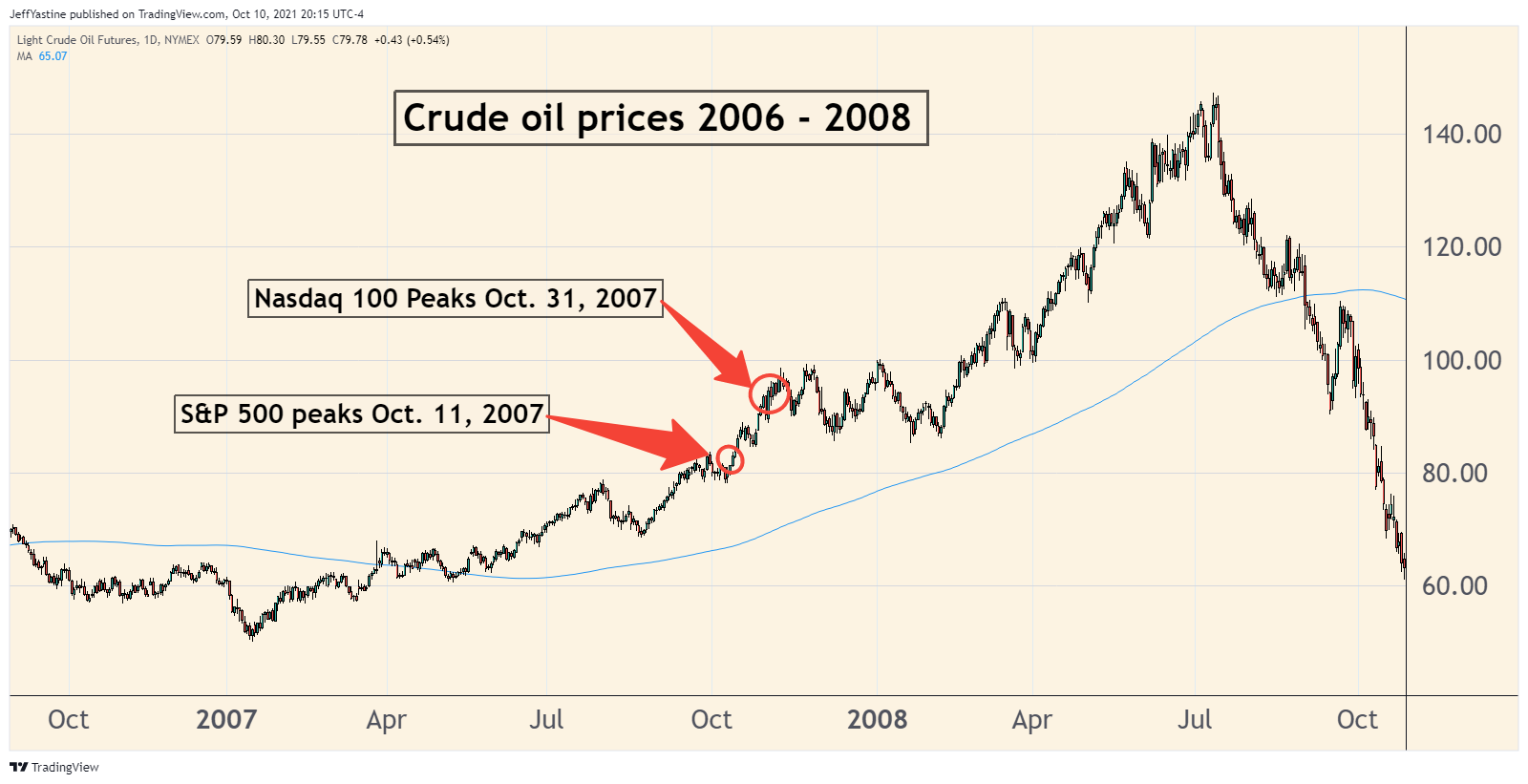

October 31, 2007 is a good example. The real estate bubble was in full bloom, and while a few were wise enough to say "this could end badly," almost no one believed it.

The Fed wrapped up its meeting. While Main Street investors thought it was "off to the races," Wall Street pros used the exuberance of that day to cash out and start heading for the exits.

The chart below speaks volumes about what happened for the next 18 months.

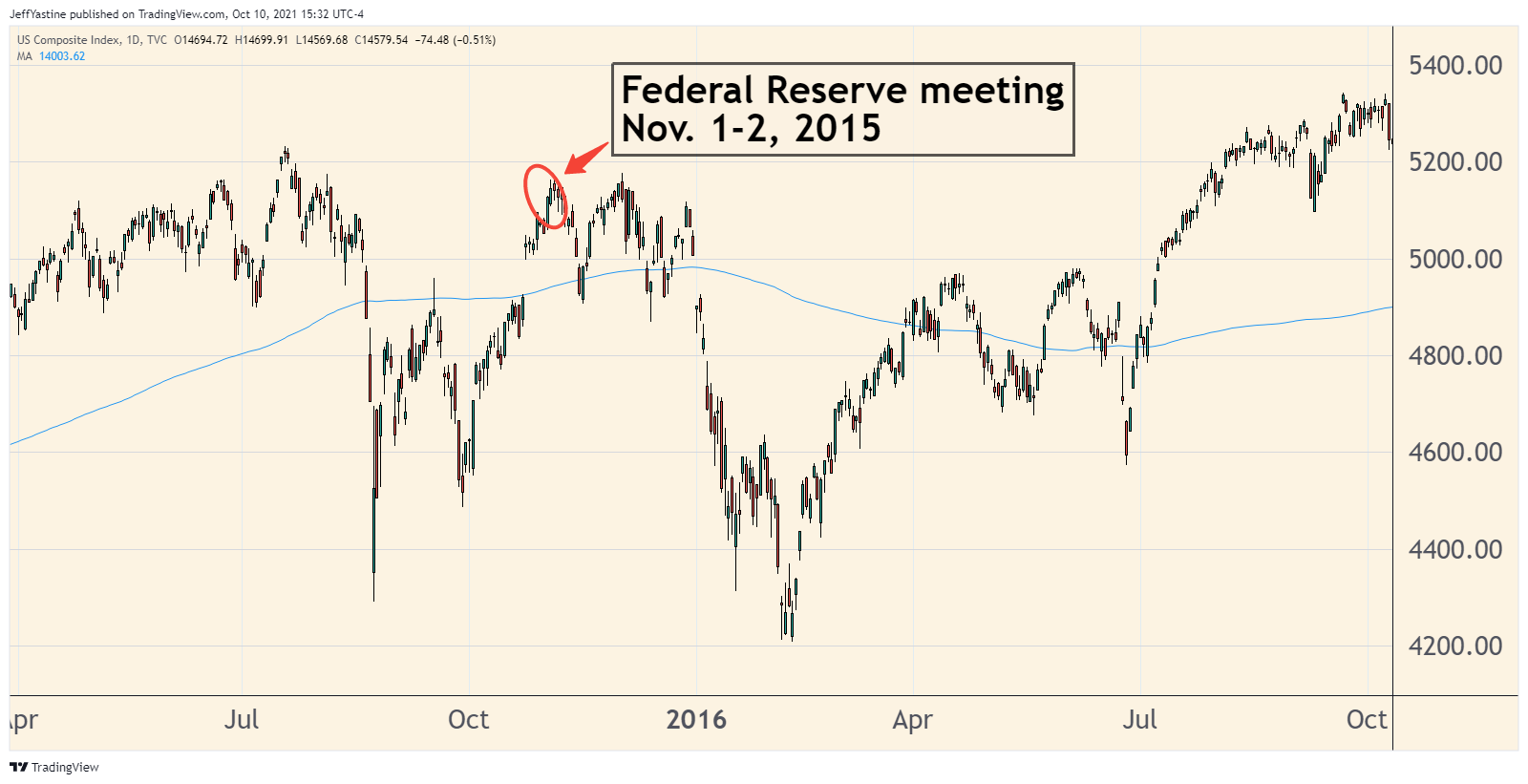

Even if we think a full blown bear market is out of the question, November 2018 shows how Wall Street uses a Fed meeting to set people up for more pain - in this case a second decline of 16% into the end of that year.

Likewise in 2016. The market rallied into the early November Fed meeting that year, setting up a 17% decline in January.

There's more though to ponder on all this.

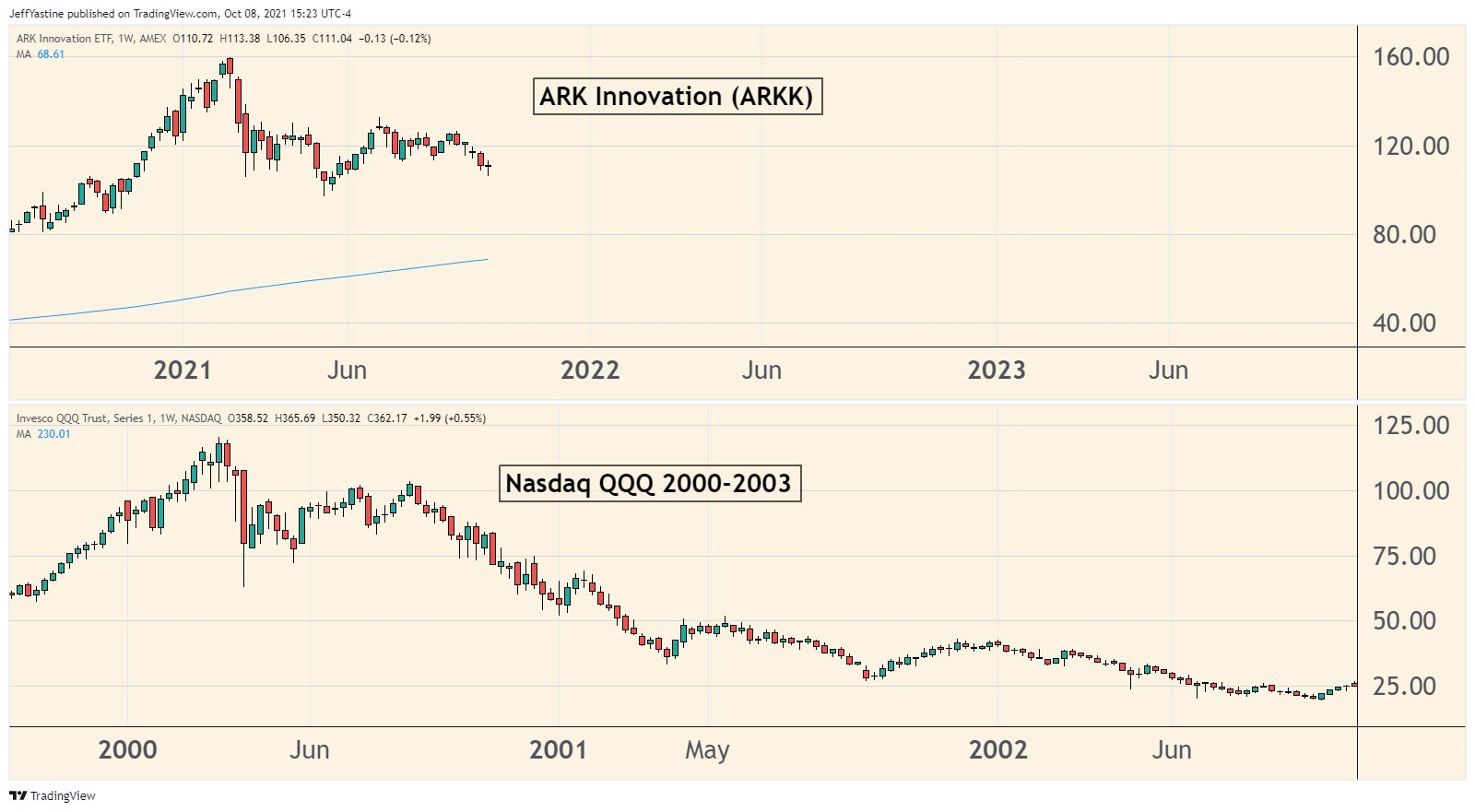

I posted this comparison chart on my Twitter account on Friday, examining the share fluctuations in ARK Innovation (ARKK), an ETF of some of the hottest new era tech stocks (and run by the very bullish and very popular fund manager Cathy Wood) versus the early phase of the 2000 Nasdaq bear market.

Let's remember too that in 2000, the Nasdaq was not the mega-cap oriented market it is today. Back then, it too was dominated by ARK-type stocks that were long an innovation and excitement - but lacking on profits and revenue.

The only reason the S&P 500 and Am I an out-and-out bear? No. Bull markets tend to keep going and going, surprising everyone along the way. We need to give this one our respect, and every benefit of the doubt.

But I've been at this game just long enough to know when to start having my doubts, even while Wall Street keeps telling us everything is OK.

There's one final chart and a question to ponder...

What happens to the stock market if the global economy starts to rev up - and oil prices keep accelerating, not just to $100 as I expect, but even higher?

The last great oil spike in 2007 gives us a clue. It wasn't sustainable, it certainly played a role in priming the economy for a recession, and killing off the stock bull market and the real estate bubble long before oil prices peaked and rolled over.

Portfolio Update

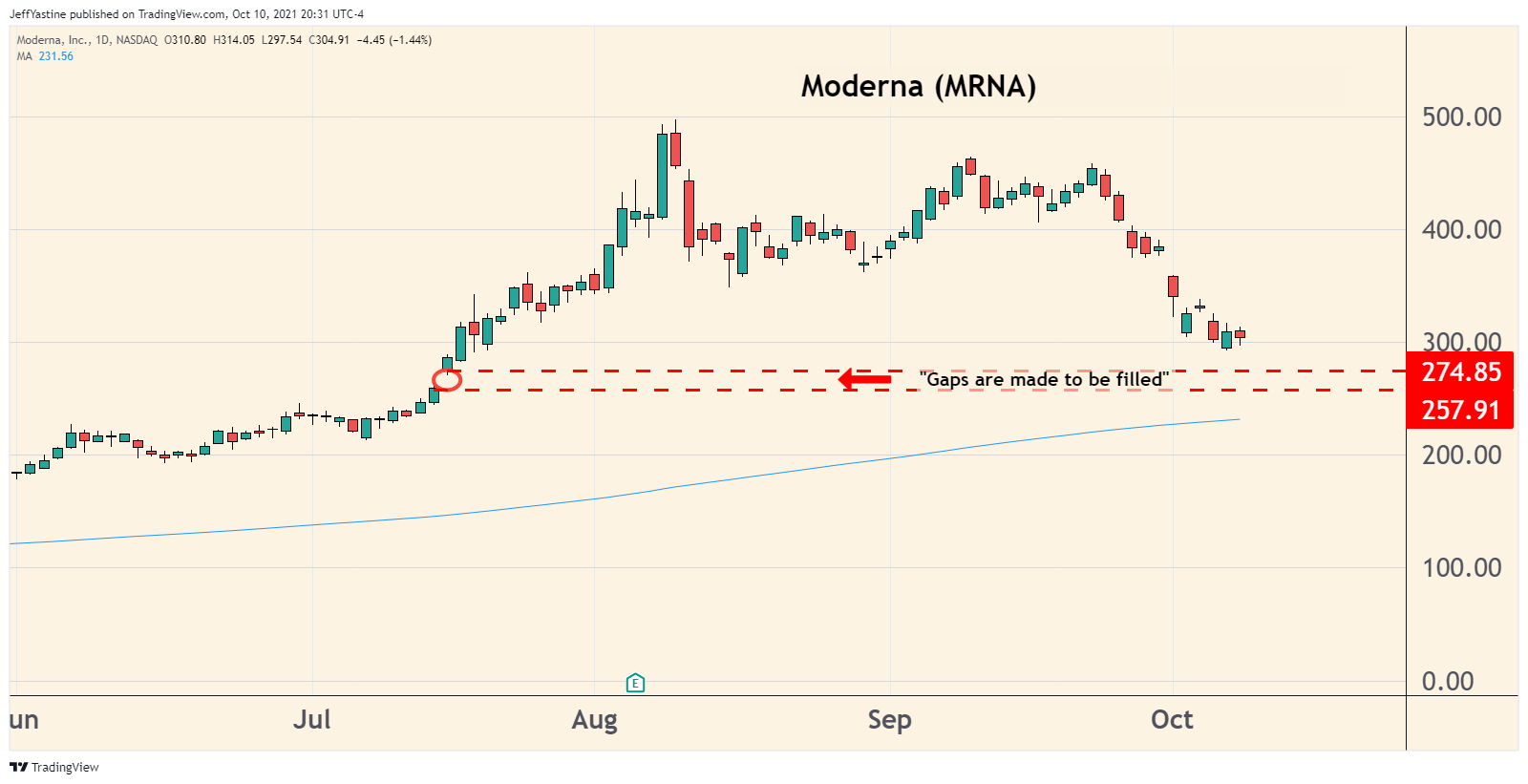

I'll limit my thoughts this week to just Moderna (MRNA), since it took a very big hit last week.

Here's the earnings reporting schedule for our portfolio:

- Signature Bank (SBNY): Oct. 15

- Valero Energy (VLO): Oct. 21

- WRAP Technologies (WRAP): Oct. 29

- Moderna (MRNA): Oct. 29

- Everspin Technologies (MRAM): Nov. 8

- RADA Electronics (RADA): Nov. 10

- Array Technologies (ARRY): Nov. 11

- Stereotaxis (STXS): Nov. 11

Moderna: As far as Moderna goes, it wouldn't surprise me to see the stock "fill the gap" at the $260 level on the chart below.

From a longer perspective though, I think the drop of the last 2 weeks puts the stock into "reset" mode.

In other words, all the "hot money" traders have fled.

Moderna is now a value-priced biotech growth stock again.

It's like we're back at the start of the year, when Moderna fell 42%, from $175 in early December to $104 by early January.

In fact, I'm going to make a prediction.

Just after, or just before Moderna reports its quarterly numbers late this month, we will see Wall Street analysts - even the ones who have been very bearish on the stock - come out of the woodwork and begin to re-recommend it again.

They will do so for a handful of reasons:

- If the stock drops to $260 (14% below the current price), the shares will have been knocked down 50% in 2 months, putting it on sale.

- Whatever concerns they have about Moderna's reliance on profits from the Covid vaccine - are already fully reflected by the subsequent decline of the stock.

- They will also tell us about the possibility that Moderna will use some of its billions in profits to step up massive buybacks of its stock.

- Analysts will tell us about the prospects for massive Covid vaccine sales in non-developed markets.

For example, Moderna said last week it would soon choose a site for a vaccine manufacturing plant in Africa, with the goal of producing 500 million doses a year. Analysts haven't even factored in these kind of numbers yet.

Lastly, I don't think analysts are done raising profit estimates for the company.

I think Moderna will beat its current quarterly target of $9.42 a share by a wide margin, when it reports its Q3 results later this month.

When it does so (and presuming it also raises its forecast for 2022), then analysts will go back to the drawing board and conclude that the company could earn perhaps $40 a share (instead of the current $30 a share estimate) for 2021, and could take in perhaps that much (instead of expectations of $29.13 a share) in 2022.

Suddenly, Moderna's previously "really expensive" stock suddenly looks downright cheap.

Moderna's shares still make up a very significant chunk of my own personal portfolio. I continue to hold the stock.

If I bought shares at the highs this summer, I'd just give it time - the stock may be "dead money" for a while because the sharp decline has scared away so many traders. But I expect the stock to make back its lost ground with some patience in 2022.

And if I didn't own Moderna, and was looking for a promising value-based biotech stock idea, the shares would be tops on my list for next year as well.

Best of goodBUYs,

Jeff

Member discussion