Is there an Apple $AAPL -Evergrande/China Connection?

The stock market right now reminds me of my basketball-playing days as a teenager.

I loved basketball. During the summers, I'd play 6-8 hours a day sometimes. I could pass, dribble - and shoot from the inside and outside pretty well. Somewhere I still have my trophies from summertime basketball camps.

But my physical skills were, um...limited. I was only 6-feet tall and wasn't a good jumper. I wasn't the fastest guy on the court either.

So when I found myself guarding someone who was faster, more agile, I had to adjust my game strategy to a lower risk, less aggressive posture.

Instead of going for the ball steal, I'd lay back. I didn't want him blowing past me for an easy layup.

Right now, we need to do the same for the stock market and the unknowable risks that come with investing and trading.

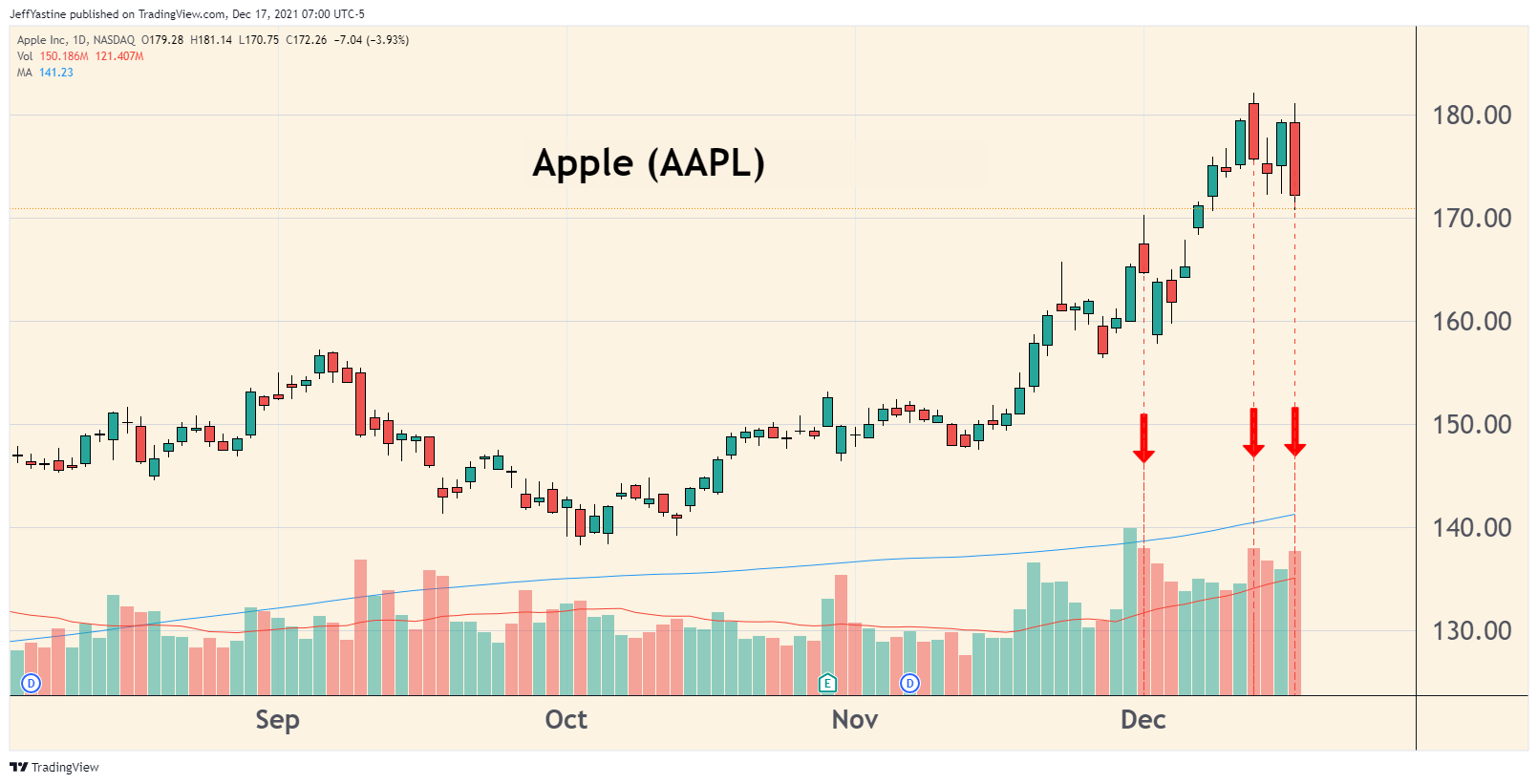

For example, keep your eye on the two Apple (AAPL) stock charts in this article.

Apple has been very very strong up until this week, when it has sold off on some of the biggest daily trading volumes of the past 9 months.

Now, a few days of excessive "downside" trading volume doesn't have to mean anything at all. That's why the stock market is all about uncertainty and probabilities - in other words, the things we don't know - instead of logic and reason, which is all the stuff we do know for sure.

So keep that in mind...all the things we don't know.

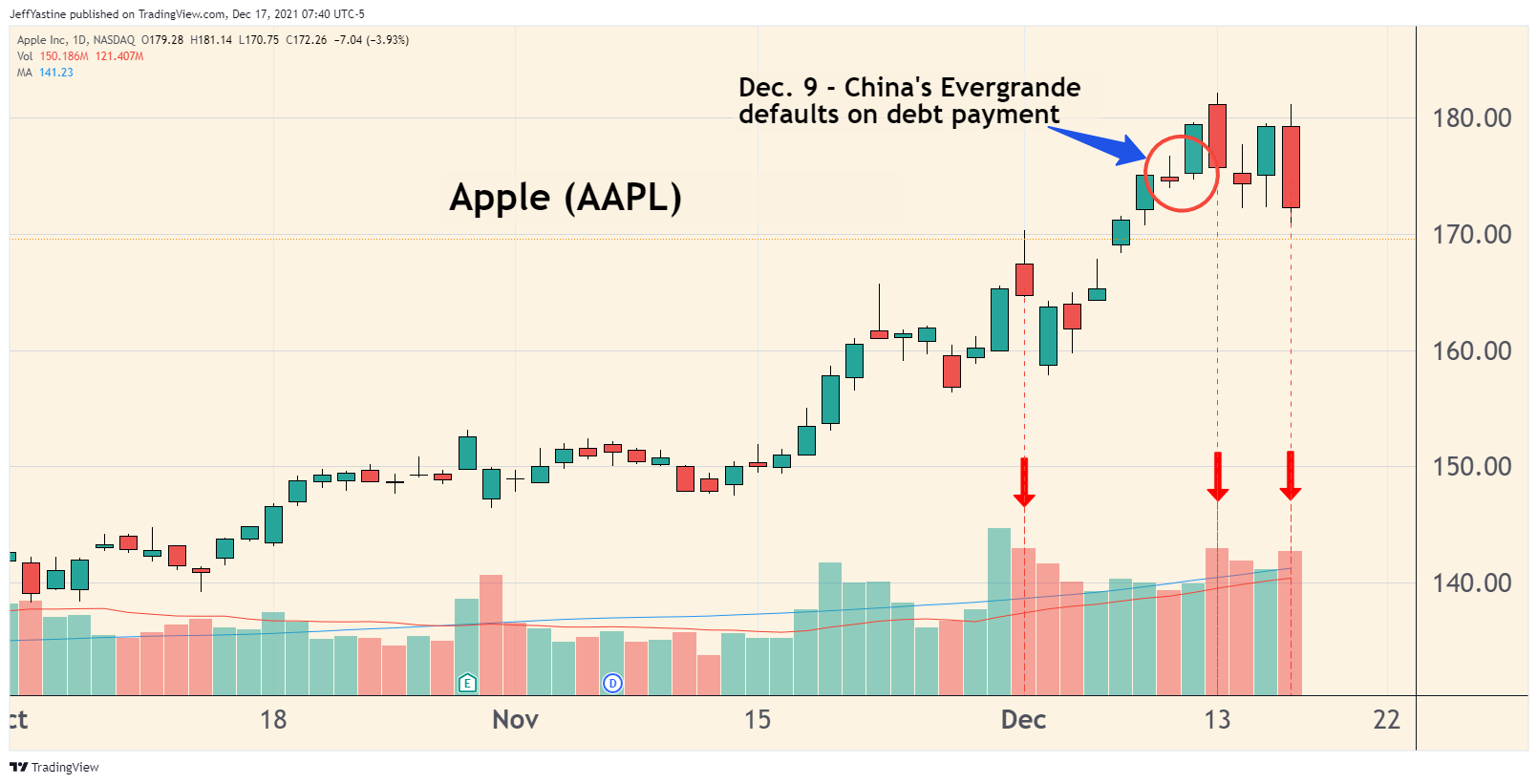

Most Americans have never heard of "Evergrande" - China's gi-normous real-estate financing conglomerate.

No one cared that Evergrande missed a debt payment last week on its massive $300 billion in debt.

But look at the same Apple chart with the Evergrande debt default added in...

Keep in mind that over the past 18 months, Chinese investors have poured more than $150 billion into US stocks, versus $40-$50 billion into their own domestic stock market.

Could Chinese traders and financial institutions be running for the exits, because of Evergrande?

I mean, what do all companies and investors do when they have a margin call, and their backs are up against the wall?

They run for the "cans"...

They sell what they can, where they can.

They try to raise as much cash as they can, as fast as they can.

Could that selling include massive amounts of the biggest US stocks, like Apple?

Perhaps. But we won't know the real answer for a while. And there's always the chance that when we finally do know the answer...it's too late for us to do anything to act on it to protect ourselves.

Like I said, that's why we have to respect "Mr. Market's" unknowable intentions these days. Keep your focus on risks for the future, as well as the opportunity for rewards that we've experienced in the past.

Best of goodBUYs,

Jeff Yastine

Member discussion