Two Years of goodBUYs!

Two years ago, on March 4 of 2021, the goodBUYreport took form with my first published stock idea.

To mark the anniversary, I thought it would be worthwhile to look at my best - and worst - stock trades (more on that below).

My mission remains the same now as when I wrote my first trade report:

The whole point of investing and trading is to make money, of course.

But it's also about survival...survival of our portfolios and self-confidence through strings of bad luck, bad stock ideas and bad markets.

If you can watch me do it here at the goodBUYreport, I think it will give you the confidence to pursue your own financial goals through the stock market as well.

So how have I done?

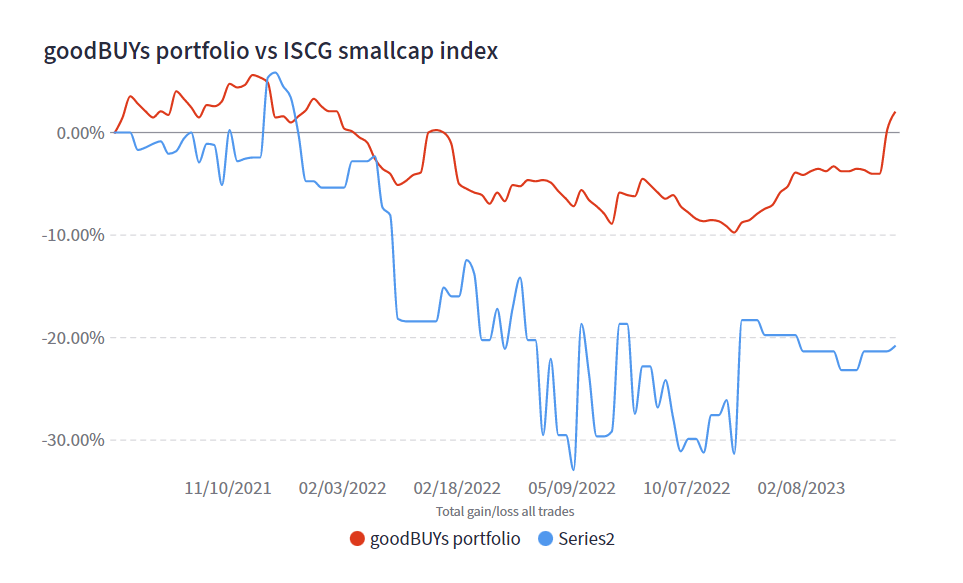

Unless you're shorting stocks or using options, "winning" in a bear market environment is really about losing the least amount of money - while still taking smart risks where and when you can. So from that standpoint, I suppose I'm ahead of the game.

But my goal with the goodBUYreport really isn't about "beating the indexes."

It's educational. As a former financial journalist, I interviewed lots of people who lost fortunes in the 2000-2003 bear market and the 2007-2009 bear market. I think of them a lot.

So the goodBUYreport is about developing good habits - cutting losses, letting your winners run - and showing how to survive, navigate and succeed through good and bad markets with our portfolios and confidence intact.

Learning from Gains & Losses

You can learn a lot by examining your wins and losses with a clear eye.

For example, in the past 2 years (much of it spent in the ongoing bear market) the goodBUYs portfolio has had some nice wins:

- Moderna (MRNA): +112% (March - December 2021)

- AVITA Medical (RCEL): +90% (January - February 2023)

- Niu Technologies ADR (NIU): +78% (November 2022 - February 2023)

- Everspin Technologies (MRAM):+53% (June 2021 - January 2022)

- Jumia Technologies (JMIA): +47% (January - February 2023)

- Everspin Technologies (MRAM): +40% (May - August 2022)

- ReNew Global (RNEW): +36% (January - April 2022

- Allegiant Travel (ALGT): +36% (January - February 2023)

- Alibaba Group (BABA): +30% (November 2022 - February 2023)

- Pretium Gold (now merged): +22% (October - December 2021)

The Moderna win, in particular, could have been larger. If I'd been smarter (and perhaps more clairvoyant), I would have sold for a +250% gain when the stock peaked in the middle of 2021.

The portfolio has also had its share of losses. Here's the top 10 over the past 2 years:

- CureVac BV (CVAC): -59% (June 2021)

- Carnival (CCL): -35% (September-October 2022)

- Viatris (VTRS): -34% (February - March 2022)

- Bioceres Crop Solutions (BIOX): -31% (May - July 2022)

- Trulieve Cannabis (TCNNF): -29% (July - September 2021)

- Jumia Technologies (JMIA): -27% (November 2021)

- PagSeguro Digital (PAGS): -26% (May - June 2022)

- Cardiovascular Systems (CSII): -21% (February - May 2022)

- PLx Pharma (PLXP): -19% (December 2021 - January 2022)

- Desktop Metal (DM): -19% (September - November 2022)

The CureVac loss is worth noting because I added it to the portfolio expecting the stock to break sharply higher - and instead it cratered 40% in a day after reporting disappointing test results.

The average gain of those top 10 best trades was 54%. The average of the biggest losses was (-30%).

But those gains and losses only tell part of the story.

The other part...the part no one ever talks about and makes the biggest difference...is risk management.

Why Risk Management is Important

Risk management is just a fancy way of making sure losses don't damage our portfolios beyond repair and recoverability.

Wall Street pros allow themselves to fall victim to a lack of risk management on a regular basis, the same as many of us regular investors when we're not careful.

Whenever you read about a mutual fund or hedge fund posting massive losses of 40-50-60% or more...a lack of risk management is typically to blame.

A fund manager may have a brilliant investing strategy. But all strategies stop working for occasional periods of time, as the market and economic environment changes.

So if the fund manager doesn't adjust his risks - making fewer bets, making smaller bets, selling parts of a portfolio to raise cash, etc. - he starts posting big losses. Once too much money is lost (the boundary is somewhere around 40-50% from my observation), the hedge fund and its manager are finished.

The fund's clients start pulling their money. They don't want to wait around for years hoping the fund manager can make back the losses.

The difference is a fund manager can shut down the operation, return any leftover funds to clients, and walk away.

We can't. The money we lose is our own.

So we can't forget about risk management, especially in the midst of an ongoing bear market.

For example, over 2 years (of mostly bear market activity) the goodBUYs portfolio has had:

- Exactly 100 trades

- 42 winners/58 losers

So from a win-loss percentage, 42% winners doesn't seem great. But it's not the win-loss rate that's important. It's how much you make when you win, and how much you lose when you don't.

- Out of those 42 winners, the average gain was +23.67%.

- Out of the other 58 losing trades, the average loss was (-11.39%).

In other words...even in the midst of a very tough bear market, I tried to cut bad trades quickly enough so that my average loss was only half the size of my average gain.

If not for that, my results - having a portfolio in positive territory instead of deeply in the red - would likely be the same as the indexes or worse.

So what's the point?

After 2 years of publication, I think I'm proving my point.

We have to make a habit of cutting our losses, and letting our winners run - even when the bear market doesn't give us many in the first place.

Jeff Yastine

Member discussion