The Case for $100 Oil: goodBUYs in "Big Energy" Stocks

Let me tell you a little story.

Last August, I took what was - at the time - a rather controversial position.

With oil prices at around $40 a barrel, I said that old-school energy stocks - oil companies, pipelines companies and such - were likely bottoming and were primed to start rising in a big way.

Watch the video for more, or read on for more details below!

In October, with the presidential election brewing in the background, I followed it up with yet another video recommending energy stocks again.

And all this was occurring against a background where most investors - including the gurus at the financial publishing house where I was working at the time - were staunchly anti-energy in their investment views.

Since publishing the first of those videos, the price of oil is up +60%. The stocks I mentioned in those videos are up very nicely as well:

- Kinder Morgan (KMI) +27% (and not including KMI's 8% annual dividend yield)!

- Exxon Mobil (XOM) +73%

- Valero Energy (VLO) +51%

- Marathon Petroleum (MPC) +86%

- Chevron (CVX) +38%

OK, so now what, you ask?

After all, the Delta variant is out there wreaking havoc on the unvaccinated folks in the US and everywhere else. So the knee-jerk reasoning is - it means a delayed economic rebound and lower oil prices in the interim. In other words, oil stocks are a bad bet.

I couldn't disagree more.

I'm betting on $100 a barrel oil by the end of this year.

Time to Back Up the (Tanker) Truck

So I can't think of a better time to either add to old positions, or get into new ones, with most major oil stocks down by double-digit percentages off their highs from earlier this year, and an ETF like iShares US Energy (IYE) likewise down about 17% and at the bottom of a months-long trading range.

The basic components for an energy stocks bull market remain in place.

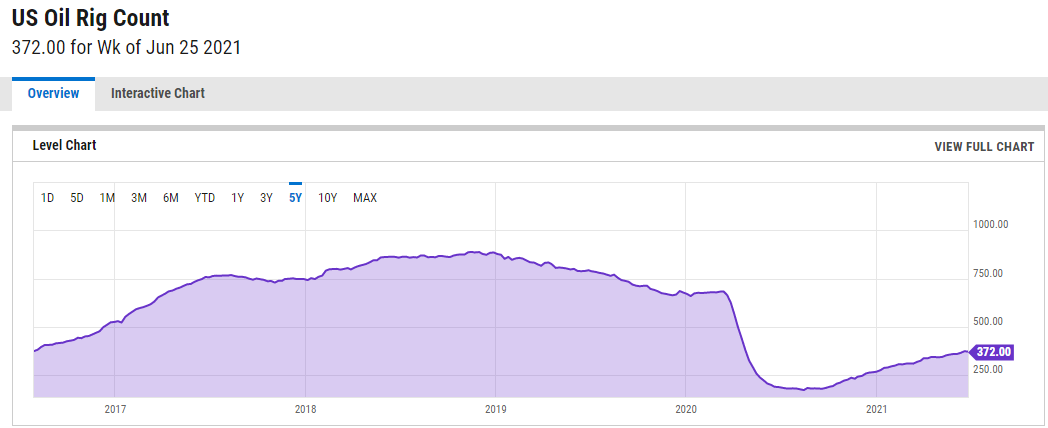

When it comes to the supply of oil, the number of US oil rigs in operation remains far below pre-pandemic levels.

In other words, energy producers just aren't that eager to get back into the ballgame. And no wonder, since they've been burned every time since 2014 with lower and lower oil prices.

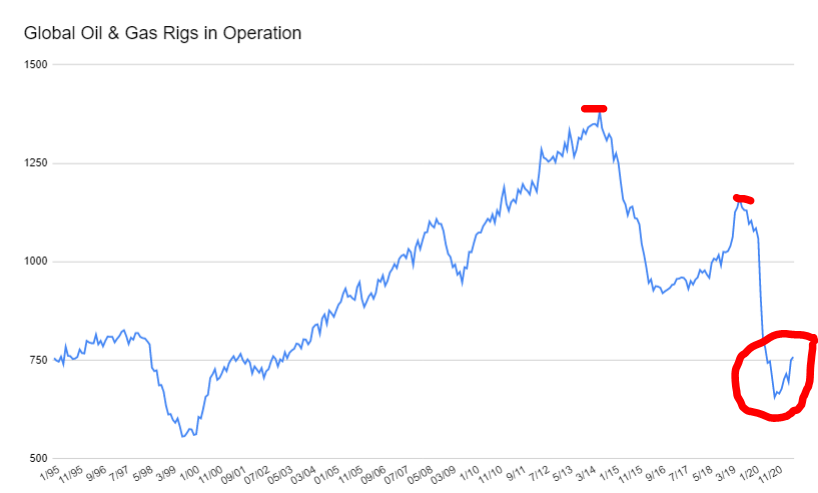

The global picture, even including rigs pumping natural gas, remains even more deeply depressed.

And for a variety of reasons - COVID, climate change, shareholder activism, and low prices in general - oil companies are going to continue to invest less in developing new oil fields to replace older, depleted ones.

The International Energy Agency noted that "sharp spending cuts and project delays are already constraining supply growth across the globe, with world oil production capacity now set to increase by 5 mb/d by 2026."

"In the absence of stronger policy action, global oil production would need to rise 10.2 mb/d by 2026 to meet the expected rebound in demand."

Energy Stocks Remain Cheap

Yet the reasons for a global recovery - and higher oil prices in coming months - remain in place, in my opinion.

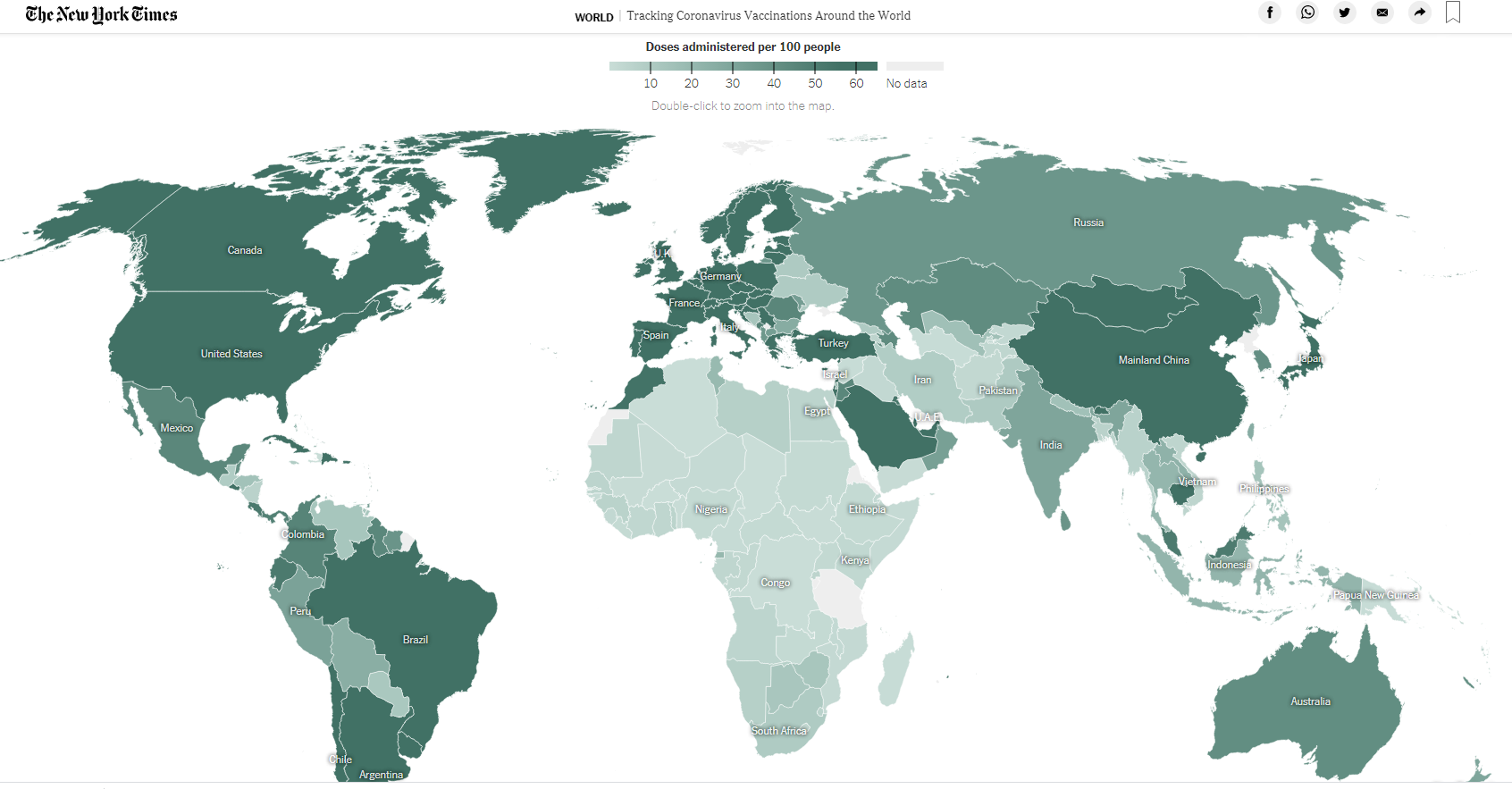

The rise of the hyper-transmissable Delta variant may have pushed it back a bit, compounded by "vaccine hesitancy" - an unfortunate and tragic problem.

But I expect 'hesitancy' to give way as the headlines continued to pound away at a key message...

Unlike this time last year, the tools to control the spread - vaccines made by Moderna or Pfizer-Biontech - are readily available in the US, and growing in availability everywhere else - although not as fast as anyone would like.

My last and most important point is that energy stocks remain cheaply priced.

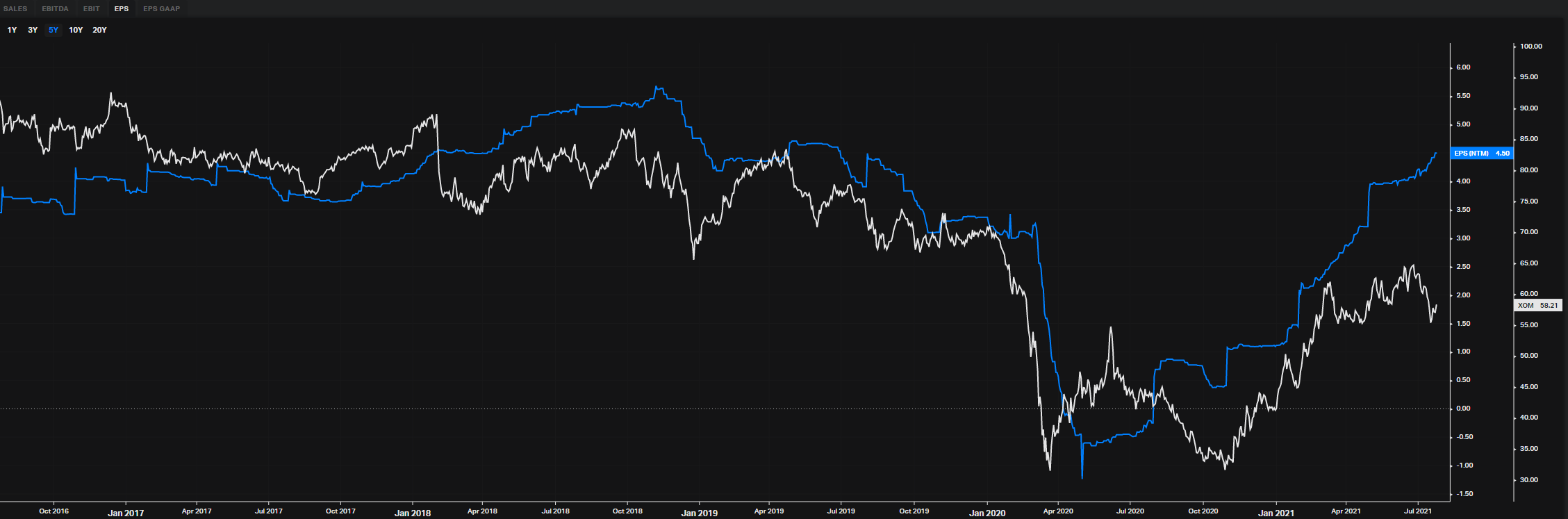

As one example, Exxon Mobil (XOM)'s stock is currently trading at a price/earnings ratio of 12.7 - its lowest such level in years.

Yet the company's earnings per share (the blue line on the chart below) continues to rebound, and is now approaching its pre-pandemic levels.

Far from "oil is dead," Exxon's earnings per share is set to rise by 10% or more in the coming year. Analysts expect profits to rise from a projected $3.99 a share this year tomore than $4.60 a share in 2022.

At the same time, Exxon - like most other large oil firms these days - is on the path towards de-emphasizing its oil assets in favor of a bigger mix of climate-friendly assets.

Putting it all in perspective here...

Is oil the fuel of tomorrow? Certainly not. I believe it's on a path to be replaced by the next-gen energy sources in years to come, like everyone else.

On the other hand, oil use isn't going to disappear quickly.

Which means companies with lots of oil assets will continue to provide value to shareholders - in the form of rising stock prices and dividends - for far longer than most investors give credit right now.

Best of goodBUYs,

Jeff

Member discussion